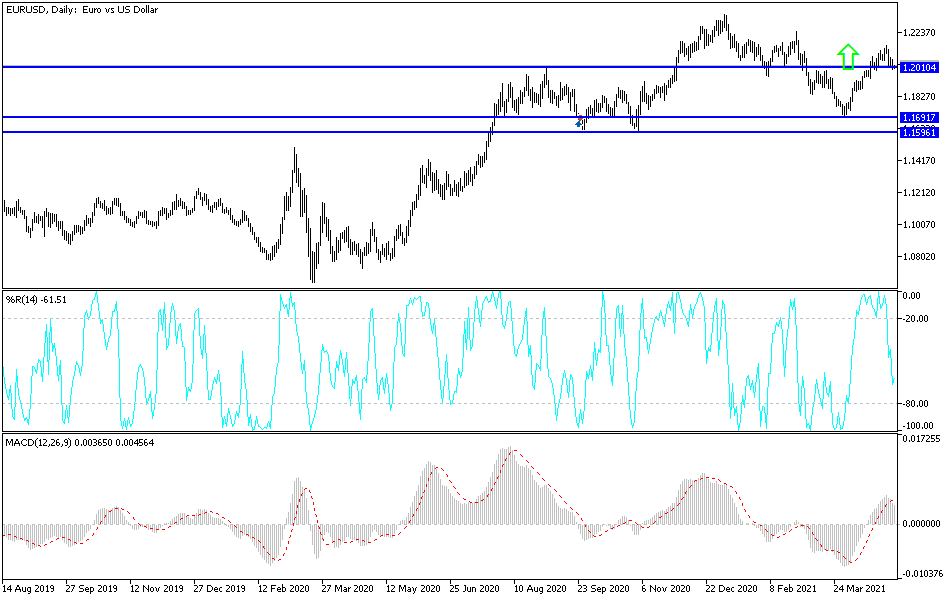

The euro fell during most of the trading session on Tuesday to reach down towards the previous downtrend line and find support. Furthermore, we are at a bit of a “perfect confluence”, as the 1.20 level is sitting right there, and the 50-day EMA is sitting there as well. With this, I think it is only a matter of time before we see buyers jump in and try to push this market back to the upside. After all, we have seen a massive shot higher, but I am not blind to the fact that we could turn things around if this keeps up.

It has been a general “risk off” day during the session on Tuesday, so it certainly makes sense that the US dollar got a bit of a bid. Nonetheless, I think that we have any real point of inflection in this general vicinity that will decide where we go next. If we get a bit of a bounce, then I think we are likely to go looking towards the 1.2150 level, perhaps to the 1.22 handle. After that, the market is likely to go looking towards 1.23 handle.

On the other hand, if we were to break down below the 50-day EMA, then I believe it is likely that the market will probably continue to go looking towards the 200-day EMA underneath, which is closer to the 1.1850 level. Ultimately, this is a market that I think would perhaps even go looking towards the 1.18 level. Breaking down below there would then certainly cause a lot of negativity to go flying into the market, perhaps kicking off even more selling pressure. Ultimately, I think that this is a market that is still trying to figure where it is going over the longer term, so I do think that we have the high likelihood of seeing some type of impulsive candlestick coming into the marketplace, which should give us a direction to go for the longer-term move. In the meantime, I would anticipate that a lot of noisy behavior will be seen, as we are waiting for the jobs number at the end of the month and are in the midst of earnings season on Wall Street. In other words, I think that we are simply waiting to be told which direction to go.