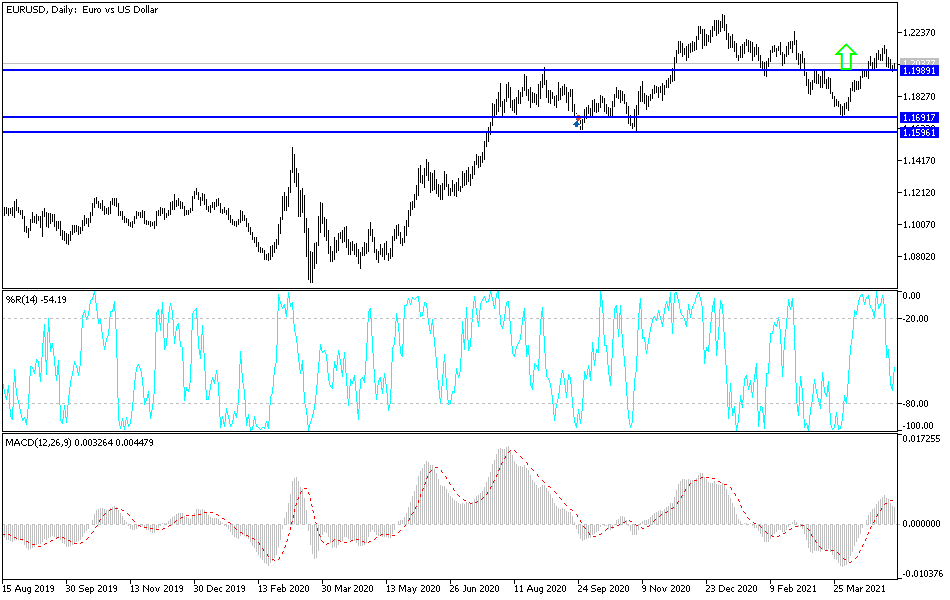

The euro went back and forth during the trading session on Thursday in a very tight range, essentially going nowhere. At this point, it looks as if we are hanging around the 50-day EMA and a whole cluster of reasons why this area should be supportive.

For starters, you can take a look at the 1.20 level as an area where we could see a bit of interest due to the large, round, psychologically significant figure. Beyond that, we have a downtrend line that has been closely followed, and now that we have broken out above it, we have then come back to retest it for potential support. Beyond that, we also have the 50-day EMA showing up in that general vicinity, so all of these things tied together probably signify that there should be a certain amount of technical buying in this area.

Furthermore, the US dollar has gotten pounded recently, so you could make an argument for a little bit of a bullish flag trying to form or a rising wedge, something of that ilk. However, if we were to break down below the 50-day EMA, it is possible that we could go looking towards the 200-day EMA afterwards, which is near the 1.1862 handle. The jobs number coming out on Friday will probably be what it takes to get this market moving, and that tends to be very noisy.

When you look at the non-farm payroll Friday sessions, you typically see a lot of volatility; but at the end of the day, it is somewhat rare to get any real directionality. However, the market has been winding up for some time, so it looks to me as if we desperately needs some type of move. The inertia is building up for a bigger move eventually, but right now it does not look like we are quite ready to make that drive. I would be cautious, but eventually we will get an impulsive candlestick that we can follow. Until then, there is not much to do, and I suspect that Thursday will probably be even less volatile due to everybody waiting on those jobs numbers the next day. We do have the MPC coming out of the United Kingdom, but that will probably have little effect here.