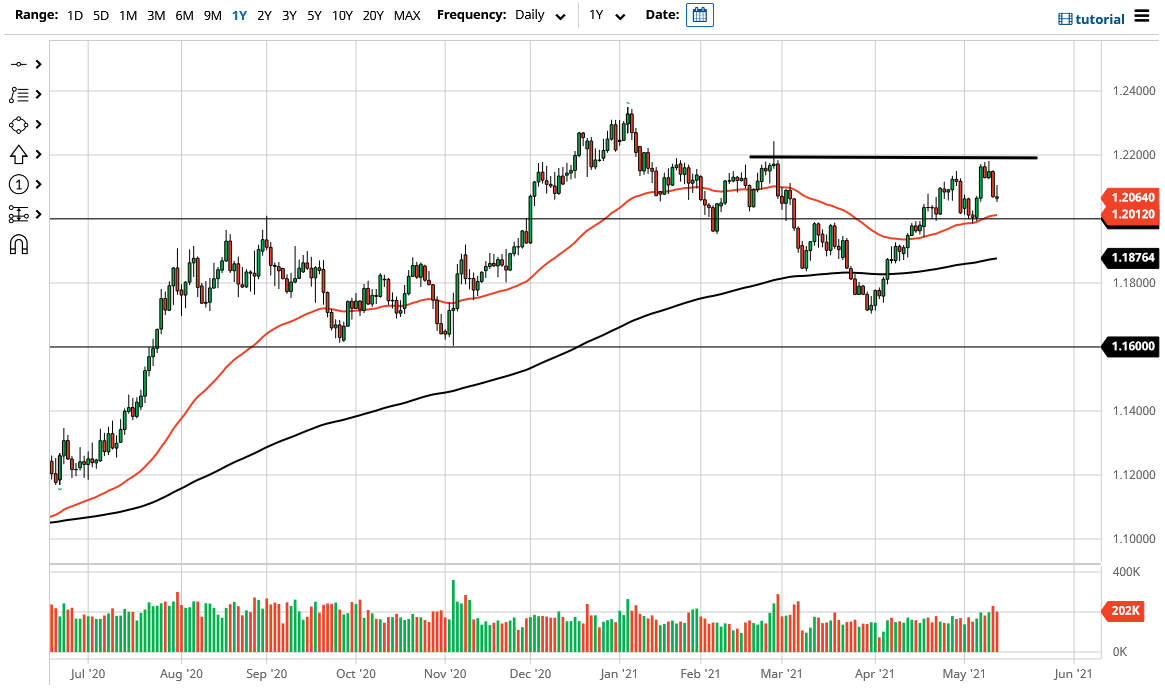

The Euro initially tried to rally during the trading session on Thursday but gave back the gains rather early and then continue to drop. By the time we closed the session, it looks as if we are trying to reach down towards the next major support level underneath which is right around the 50 day EMA. Furthermore, you should pay attention to the fact that the 50 day EMA is sitting just above the 1.20 level, which of course in and of itself will attract a certain amount of attention.

While it does look like we could pull back a little bit further, it is not necessarily a sign that we need to worry about this market. After all, choppy behavior is typical for the Euro, which is what makes it somewhat difficult to trade at times, because it simply tends to grind back and forth. With that in mind, I think you need to look for the bottom of the overall range that we are currently in, and therefore I like the idea of somewhere near the 1.20 handle getting our opportunity.

On the other hand, if we were to turn around a break above the top of the candlestick then it is likely that the market goes looking towards 1.22 level. That is an area that has been resistance before, and as a result I think it is worth paying close attention to. If we can break above there, then it opens up the possibility of a move towards the 1.23 level, which was massive resistance several months ago. Longer-term, I think we are trying to get there as the US dollar is getting sold off against most currencies, but in this particular parents market to get there anytime soon.

If we were to break down below the 1.20 handle, it is very likely that the market goes looking towards the 200 day EMA underneath, which would be even more supportive, as this pair does tend to fall that indicator quite closely. All things been equal, I think we get a buying opportunity but is probably lower than we are right now. With this, I think volatility continues, but a better word is probably “choppiness.” The overall trend is to the upside, so I do not want to fight it anytime soon.