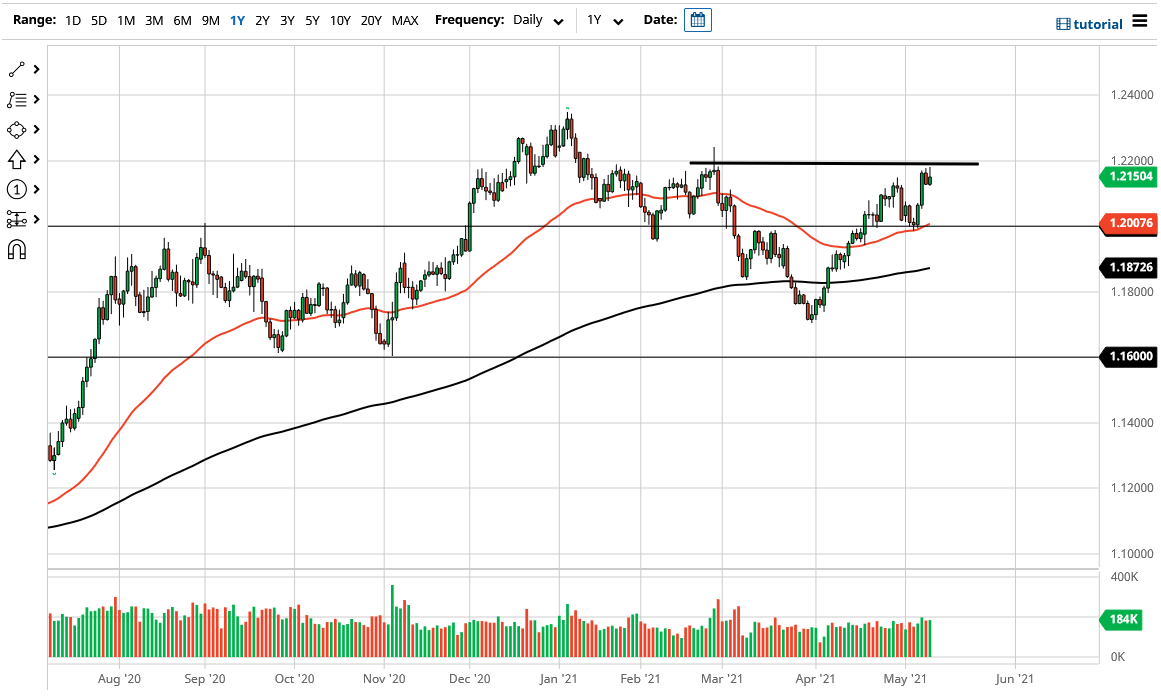

The Euro initially shot higher during the course of the trading session on Tuesday but found the 1.22 level as resistive. Because of this, the market is likely to continue to see a lot of trouble in that area, so I think it is only a matter of time before we would see sellers yet again. Nonetheless, it certainly looks as if we are trying to do everything, we can in order to break above there. If we break above the 1.22 handle, I think it is likely that we are going to go looking towards the 1.23 level, an area that also has been recently important and I think that continues to see a lot of attention.

On the other hand, if we break down below the bottom of the candlestick it is likely that we will see a move towards the 1.20 handle, which also has the 50 day EMA sitting at it as well. Ultimately, this is a market that I think is somewhat range bound in the short term, building up enough momentum to finally take off to the upside. Keep in mind that the US dollar continues to get hit, and even though we did pullback quite a bit during the session and it should be noted that the US dollar was traded against most of the session in multiple currencies, even though the Euro is somewhat quiet in comparison.

I do think that we probably have a lot of noise in general, but the last couple of days have simply been a matter of trying to work through the froth of the last couple of parabolic candlesticks. Nonetheless, I think that looking for dips to as value that bounce would be the best way to trade this market. We are starting to see better economic numbers coming out of the European Union, so that of course will help the idea of the Euro going higher. I think more importantly we are talking about the US dollar weakness more than anything else here, so keep an eye on the US Dollar Index, and of course the bond markets in general as they will more than likely lead the way. Regardless, I think is going to be very noisy over the last couple of days so make sure to keep your position size appropriate.