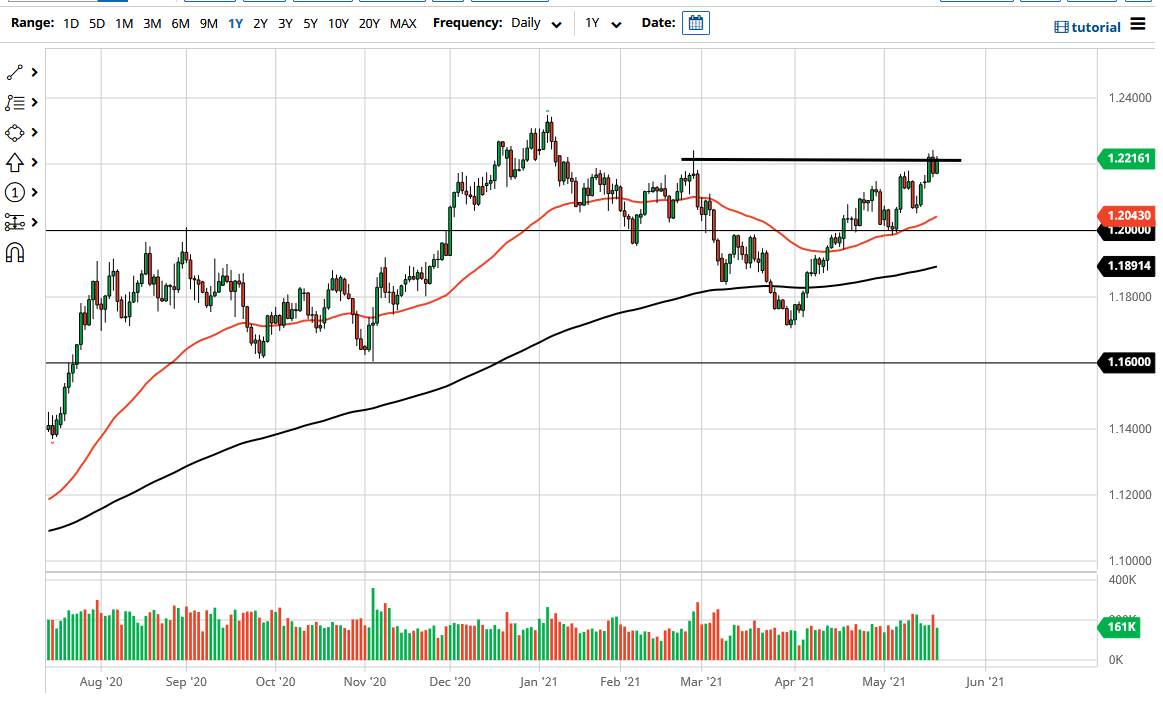

The Euro has rallied a bit during the trading session on Thursday to reach towards the 1.22 handle, an area that we have seen a significant amount of resistance over the last couple of days. Furthermore, it was important last spring, as it is an area where we had seen selling pressure. At this point in time, the market is likely to go higher given enough time, but we need to see some type of impulsive green candlestick to get going. Furthermore, we could also see some type of pullback in order to build up the necessary momentum, as we are not only facing resistance from a horizontal standpoint but also from the top of short-term channel.

At this point, I do not really have a scenario in which I want to start shorting this market, but I do recognize that if the 1.20 handle were to be broken to the downside that could be a very negative sign. I think over the next several candlesticks we will probably see a lot of back and forth, so short-term intraday traders will probably look at this more or less from a consolidation standpoint.

Breaking above the highs of the Wednesday session could be the key to going higher, perhaps reaching towards the 1.23 handle. It is at the 1.23 handle that we pulled back from last time, so clearing that level to the upside could open up the possibility of a move towards the 1.25 handle, an area that has been important multiple times in the past.

The 1.21 handle and the 50 day EMA both are between here and the 1.20 handle and should offer plenty of support. I think at this point it is simply about the US dollar and not so much about Euro, despite the fact that Germany has seen interest rates almost get to the 0% level, after being negative for ages. Negative interest rates turning towards positive will continue to propel the Euro, as interest rate differential starts to shrink. Furthermore, the reopening trade suggests that Europe will continue to strengthen overall, so I think it does make a certain amount of sense that we could go higher. This does not mean that we get straight up in the air, but I do think that there is going to be a proclivity to rise over time.