Bearish View

- Set a sell-stop at 1.2000 and a take-profit at 1.1900.

- Add a stop-loss at 1.2050.

- Timeline: 1-3 days.

Bullish View

- Set a buy-stop at 1.2050 and a take-profit at 1.2150.

- Add a stop-loss at 1.2000.

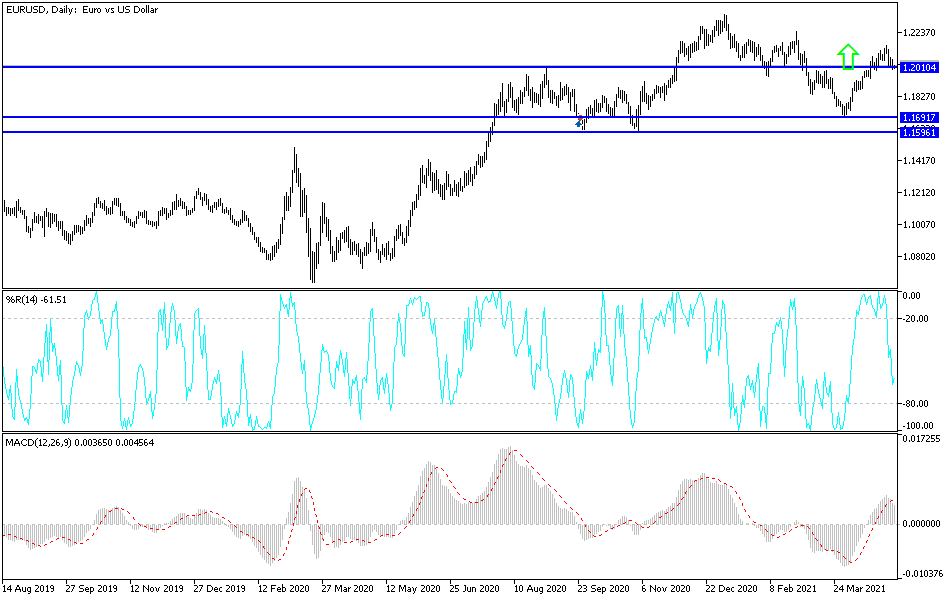

The EUR/USD price has formed a bearish pennant pattern as the market starts to price in higher interest rates or Fed tapering as the economy rebounds. It is trading at 1.2020, which is slightly above yesterday’s low of 1.200.

US Higher Interest Rates

The EUR/USD declined yesterday after Janet Yellen opined that the Federal Reserve should start tightening its monetary policy to prevent the economy from overheating. This view is being shared by many market participants considering that the American economy seems to be in good shape as evidenced by the recent strong data and the rising bond yields.

Recent numbers have been relatively strong. The country’s unemployment rate is expected to drop to 5.7% when the Labor Department publishes the jobs numbers on Friday. At the height of the pandemic, the rate rose to almost 15%. Similarly, inflation has jumped to more than 2% while the retail sector is doing well as many states reopen.

Higher interest rates in the US tend to be bullish for the US dollar and thus bearish for the EUR/USD pair. This is because such rates make the greenback more attractive to foreign investors.

Later today, the EUR/USD will react to the ADP jobs numbers that will come out in the afternoon session. Analysts expect the data to show that the private sector added more than 800k jobs in April after adding more than 517k in March. The pair will also react to the latest Services PMI data from the United States and in the Eurozone. Other important numbers will be Europe’s Producer Price Index (PPI) and the composite PMI data.

EUR/USD Signal

The four-hour chart shows that the EUR/USD pair has been in a steady downward trend recently. On Friday last week, the pair managed to break out below the important support level at 1.2050. The pair’s downward trend is being supported by the 25-day and 15-day exponential moving averages (EMA).

The pair also seems to have formed a head and shoulders pattern that is usually a bearish sign. It is also forming a bearish pennant pattern that is also a bearish signal. Therefore, there is a probability that the pair will continue falling as bears target the next important support at 1.1900, which is 1% below the current level. However, a move above the right shoulder at 1.2076 will invalidate this trend.