Bullish View

- Set a buy stop at 1.2178 and a take-profit at 1.2250.

- Add a stop-loss at 1.2140.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.2125 and a take-profit at 1.2050.

- Add a stop-loss at 1.2180.

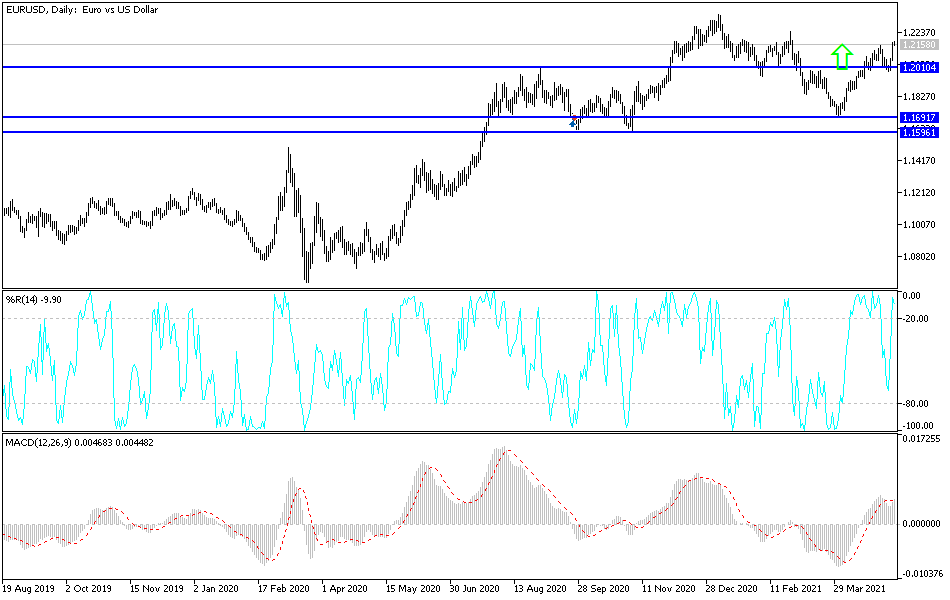

The EUR/USD pair is little changed as traders reflect on the Friday’s surge following the disappointing US non-farm payrolls numbers. It is trading at 1.2152, which is slightly below Friday’s high of 1.2178.

Fed Justified?

The Federal Reserve has been relatively dovish in the past few meetings. While flash economic numbers have pointed to a strong rebound, the central bank has insisted that the economic recovery was uneven. As a result, the bank has long insisted that it won’t hike interest rates and taper its asset purchases for a while.

Therefore, the case for lower interest rates was made stronger on Friday, when the United States published weak non-farm payrolls (NFP) data. The numbers revealed that the American economy added slightly above 200,000 jobs in April while the unemployment rate rose. Most importantly, the Bureau of Labour Statistics (BLS) revised the March payroll data lower.

The disappointing jobs numbers were mostly because of the government’s enhanced unemployment insurance. The package is paying people hundreds of dollars every week. To many low-level employees, these benefits are substantially higher than what they would earn at work.

As such, this will be an important week for the EUR/USD pair since the US will publish the latest inflation and retail sales numbers on Wednesday and Friday. In general, analysts expect that inflation rose by more than 3% while retail sales surged in April as people continued to spend their stimulus checks. If the numbers come out weaker than expected, it will mean that the Fed will be justified to leave interest rates and QE unchanged for a while.

There will be no major economic data from the United States and Europe today. As such, focus among traders will be on the US labour market and the upcoming retail sales, inflation, and JOLTs job openings numbers.

EUR/USD Forecast

The four-hour chart shows that the EUR/USD pair has been in an overall bullish trend for a while. This month, however, the pair has been in a relatively bearish trend. In full, the decline was part of a bullish flag pattern. On Friday, the pair managed to move above the upper side of the flag and the highest point in April. It is also being supported by the 25-day and 15-day exponential moving averages (EMA). Therefore, while a short pullback is likely, the bullish trend will remain so long as the price is above the moving averages.