Bearish View

- Sell the EUR/USD pair and set a take-profit at 1.200 (38.2% retracement).

- Add a stop-loss at 1.2180.

- Timeline: 1 day.

Bullish View

- Set a buy stop at 1.2150 and a take-profit of 1.2200.

- Set a stop-loss at 1.2100.

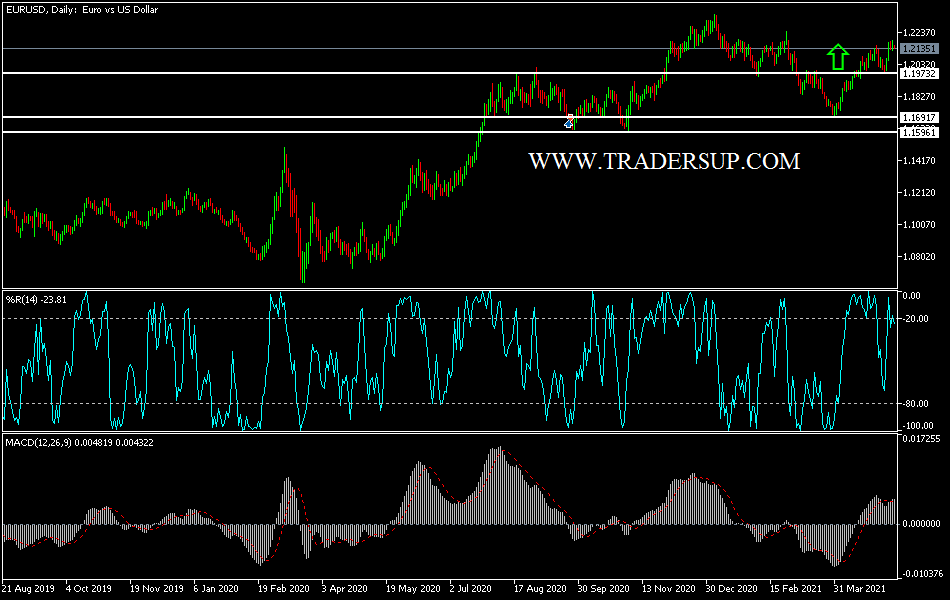

The EUR/USD formed a double-top during the American and Asian sessions as traders waited for the latest US consumer inflation data. It is trading at 1.2126, which is slightly lower than this week’s high of 1.2180.

US Inflation Numbers in ocus

The EUR/USD retreated after surging to a multi-month high earlier this week. This decline came at a time when fears of inflation have accelerated, leading to a sudden decline of US stocks. Indeed, the Dow Jones, Nasdaq 100, and S&P 500 indices have declined in the past few consecutive days. At the same time, bond yields have risen, with the 10-year yield rising to 1.629% and the 30-year rising to 2.35%. Gold, which is often seen as a hedge of inflation, has risen to a three-month high.

The ongoing price action is mostly because of inflation fears as prices of commodities surge. Indeed, some of the most important commodities like iron ore and copper have risen to an all-time high. Gasoline has jumped by more than 150% in the past 12 months while lumber has risen by more than 350%. As a result, house prices have risen substantially.

Therefore, the pair will react to the latest US inflation numbers. Analysts polled by Reuters expect the data to show that consumer prices rose by 0.2% in March while core CPI rose by 0.3%. The year-on-year gains will likely rise because of the depressed market conditions in the first part of 2020.

Higher inflation could pressure the Fed to change its tune on tightening. In the most recent meeting, the bank termed the conditions as transitionary and pointed to tightening in 2024. Therefore, if inflation keeps rising, the bank will likely start tapering its asset purchases earlier. Furthermore, while the unemployment rate rose, there are signs that the labour market is tightening since vacancies have kept rising.

EUR/USD Forecast

The EUR/USD pair formed a double-top pattern at the 1.2183 level. In technical analysis, this price action is usually a bearish sign. The pair has also crossed the 25-day and 15-day moving average, which is a sign that bears are prevailing. Also, it has dropped below the important support at 1.2150 while the MACD has continued to drop. Therefore, the pair may keep falling ahead and after the US inflation numbers. If this happens, the next key level will be the 23.6% retracement at 1.2070 followed by the 38.2% retracement at 1.200.