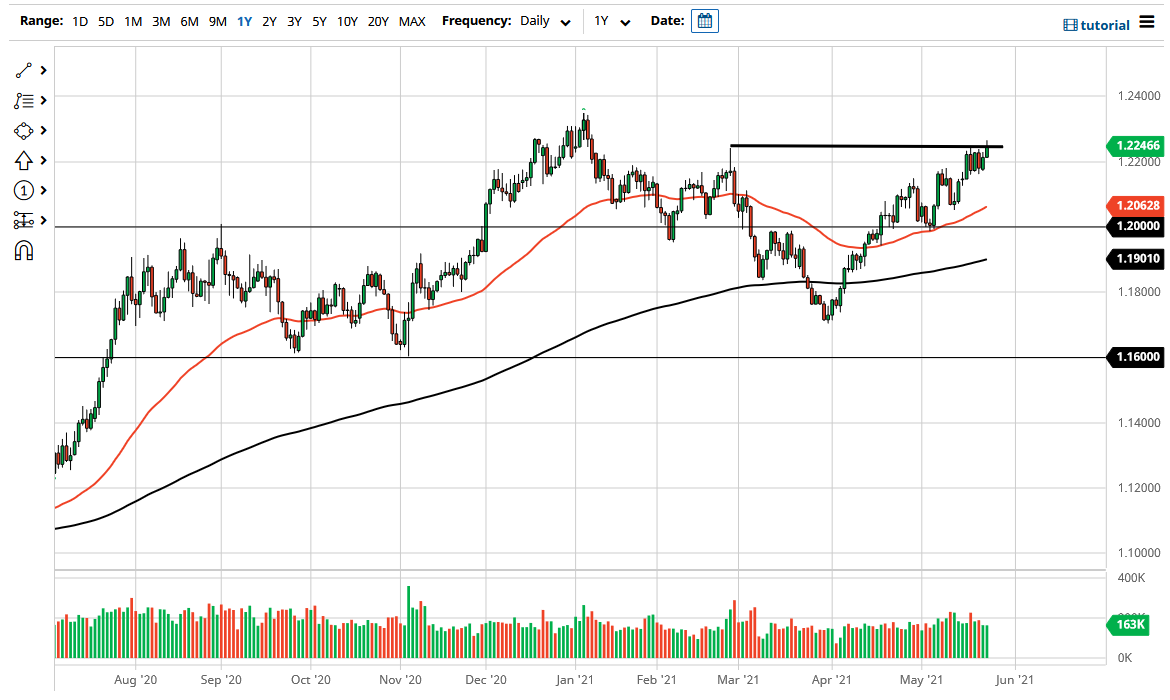

Bearish Signal

- Set a sell-stop at 1.2220 and a take-profit at 1.2162.

- Add a stop-loss at 1.2270.

- Timeline: 1 day.

Bullish View

- Set a buy-stop at 1.2270 and a take-profit at 1.2300.

- Add a stop-loss at 1.2220.

The EUR/USD retreated in the overnight session as investors reflected on the strong home prices from the United States. The pair dropped to 1.2235 after surging to the highest level since January this year.

US Home Sales Jump

On Tuesday, the EUR/USD pair jumped to the highest level since January after the relatively mixed economic data fron Germany, the biggest economy in the Eurozone. Numbers by the country’s statistics agency revealed that the economy contracted by 1.8% in the first quarter after it rose by 0.3% in the previous quarter. This drop led to a 3.4% year-on-year decline because of the lockdowns the country implemented to curb the virus.

The pair then rose after the positive German business expectation data. According to the ifo Institute, the country’s business climate increased from 96.6 in April to 99.2 in May. Similarly, business expectations and the current assessment increased to 95.7 and 102.9, respectively. These numbers are important because they are leading indicators of business spending, which is a key contributor of a country’s GDP.

The EUR/USD then erased these gains after the relatively strong house price data from the United States. According to the CoreLogic Case-Shiller Index, house prices rose by 13.2%v in March, the highest level since 2005. This was an improvement from the previous month’s increase of 12%. This growth is mostly because of the ongoing low-interest rates that have incentivized people to buy homes. Also, it is because of the ongoing trend by home buyers to move from apartments to suburban homes.

On the negative side, data by the Conference Board showed that consumer confidence declined from 117.5 to 117.2. This trend was because many people were less optimistic about future job prospects. Additionally, new home sales declined by 5.9% in March. Later today, the EUR/USD will react to the latest US Mortgage Index data.

EUR/USD Technical Forecast

The four-hour chart shows that the pair rose to the highest level since January yesterday and then erased some of these gains. This happened as the price tested the upper side of the rising wedge pattern. The pair also dropped below the important support at 1.2242, which was the previous highest point this year. It is also slightly above the 25-day and 15-day moving averages. Therefore, there are two possible scenarios going forward. The pair may keep falling as bears target the lower side of the rising wedge pattern. Alternatively, it may keep rising as it is supported by the two moving averages.