After the dust caused by the US job numbers settled, the US dollar reacted positively to the announcement of the US CPI reading. Accordingly, the EUR/USD pair retreated to the support level of 1.2065, where it stabilized at the beginning of trading on Thursday. The pair's gains during this week reached the resistance level of 1.2181, its highest in more than two-and-a-half months.

According to the data results, the US CPI for April, excluding food and energy, outperformed the expected change (annual) by 2.3%, with a change of 3%. The index also beat the monthly reading by 0.3%, with a reading of 0.9%. On the other hand, the general CPI for the month exceeded expectations of 3.6%, with a change (annual) of 4.2%, while its equivalent on a monthly basis exceeded expectations of 0.2% with a rate of 0.8%. The growing concern over inflation contributed to the heavy sell-off in stock markets this week. Any major acceleration in inflation would be a burden on the market and potentially endanger the economic recovery.

Federal Reserve Chairman Powell said last month that he expected the rise in inflation to prove temporary, once supply shortages are addressed. Fed policymakers have stressed that one-off increases are not the same as a tough bout of inflation, characterized by persistent and chronic increases in rates.

From the European Union, the German Harmonized Consumer Price Index for April matches the expected (annual) change of 2.1%. The EU's seasonally adjusted industrial production declined for April, the forecast change (monthly) of 0.7% with a change of 0.1%. Meanwhile, the French CPI for April missed expectations on both (annual) and (monthly) basis, while the German numbers were identical.

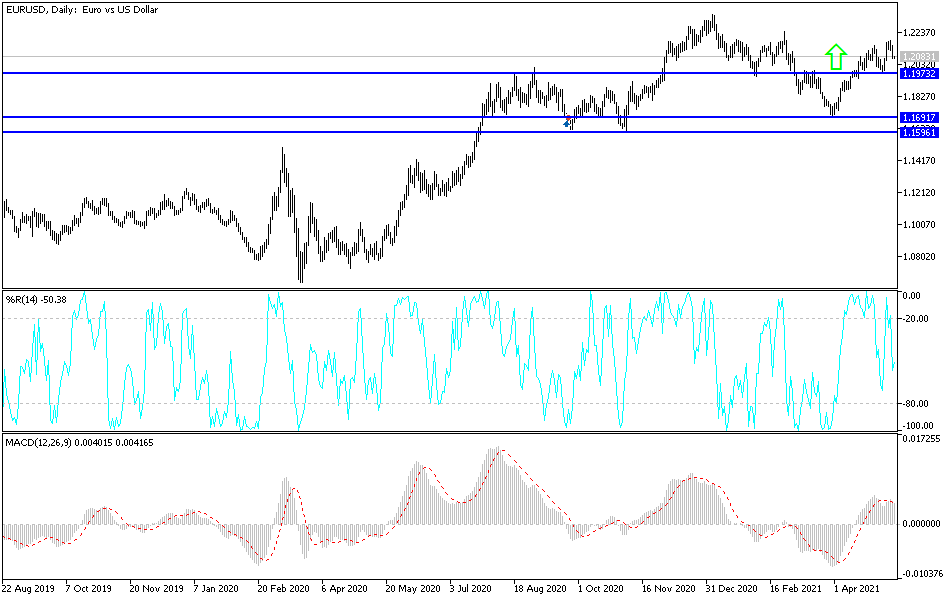

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the EUR/USD currency pair is trading within the formation of a descending channel, which indicates a slight short-term downward momentum in market sentiment. Accordingly, the bulls will target short-term retracement gains at around 1.2150 or higher at 0.00% Fibonacci at 1.2172. On the other hand, the bears will look to pounce on potential dips around the support at 1.2100 or below at the 38.20% Fibonacci level at 1.2080.

In the long term, based on the performance on the daily chart, it appears that the EUR/USD currency pair has recently made an upward recovery from a sharp decline. It is now stable above the 61.80% Fibonacci level on the way to the upside. It also rose near overbought levels in the 14-day RSI. Accordingly, the bulls will target long-term gains around 76.40% Fibonacci at 1.2198 or higher at 1.2292. On the other hand, the bears will target potential pullbacks at 50% and 38.20% Fibonacci levels at 1.2028 and 1.1950.

The currency pair will be affected today by the announcement of the number of US jobless claims and the inflation reading by the US Producer Price Index.