By the end of last week's trading, the EUR/USD pair plunged to the support level of 1.2016, and its upward correction gains pushed the pair to the resistance level of 1.2150, a 2-month high. Contributing to the sell-off was data that showed that the Eurozone economy slipped back into recession in the first quarter, as restrictions imposed to contain the coronavirus pandemic led to a decline in economic activity.

GDP contracted by -0.6% from the fourth quarter, when the GDP fell by 0.7%. The GDP was expected to decline at a faster rate of 0.8%. After record growth in the third quarter of 2020, the GDP fell for the second time in a row, pushing the economy back into a technical recession.

On an annual basis, the GDP decreased by 1.8% in the first quarter, but slower than the decline of 4.9% in the fourth quarter. The GDP in the European Union contracted by 0.4% in the first three months of 2021, and by 1.7% from last year.

According to the European Statistics Office Eurostat, annual growth rates were negative for all European Union countries with the exception of France and Lithuania.

Germany’s GDP contracted in the first quarter after recovering slightly in the second half of 2020. GDP fell by 1.7%, in contrast to the 0.5% growth recorded in the fourth quarter of 2020. On the other hand, the EU core CPI for April came in below expectations at 0.9% with a change (annual) of 0.8%. The general Consumer Price Index for the period matched the forecast of 1.6%.

From the US, the preliminary annual GDP growth rate for the first quarter outperformed the expected change of 6.1% with a change of 6.4%. The figure (quarterly) was also better than expected with a 4.1% change vs. 2.5% expectation. Prior to that, US durable goods Oorders for the month of March were announced, and expectations were for a change of 2.5% and a record of 0.5%. Non-defense capital goods orders outside of aircraft came in below 1.5% with a change of 0.9% while durable goods orders outside transportation matched expectations of 1.6%.

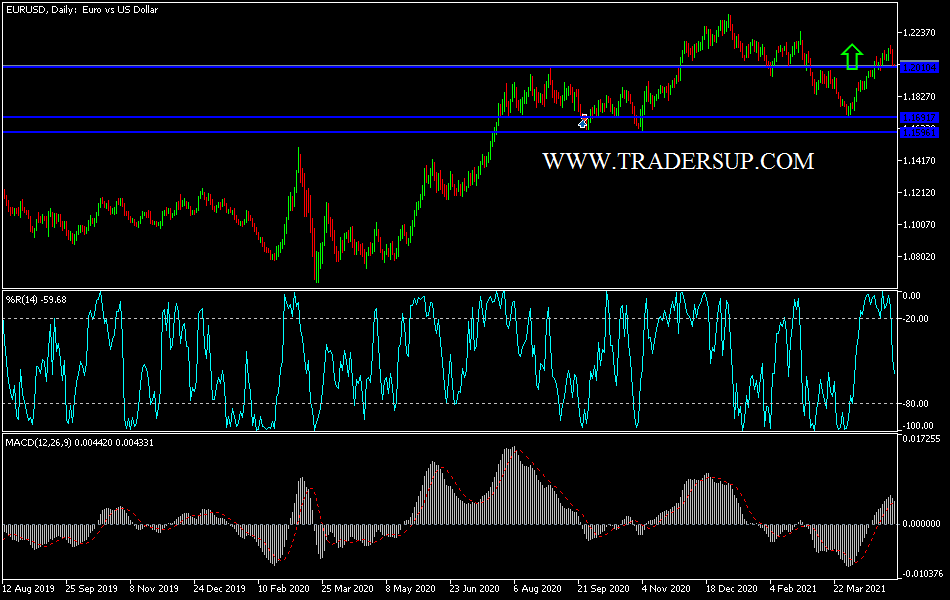

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the EUR/USD pair has recently retreated to deviate from forming the bullish channel, which indicates a sudden change in market sentiment from bullish to bearish. Therefore the bulls will target short-term gains around 1.2050 or higher at 1.2094. On the other hand, the bears will be looking to pounce for profits around 1.1996 or lower at 1.1950.

In the long term, according to the performance on the daily chart, it appears that the EUR/USD is trading within an upward channel formation. It recently recovered from the decline, rising above the 23.60% Fibonacci level. This indicates an upward momentum in the market. Accordingly, the bulls will look to ride the current bullish wave towards 1.2177 or higher at 0.00% Fibonacci at 1.2344. On the other hand, the bears will target pullbacks around 1.1854 or below at the 38.20% Fibonacci level at 1.1690.

The Industrial Purchasing Managers' Index (PMI) reading for the Eurozone economies will be released. During the US session, the ISM Manufacturing PMI reading and the construction spending rate will be announced, followed by new statements by US Federal Reserve Chairman Jerome Powell.