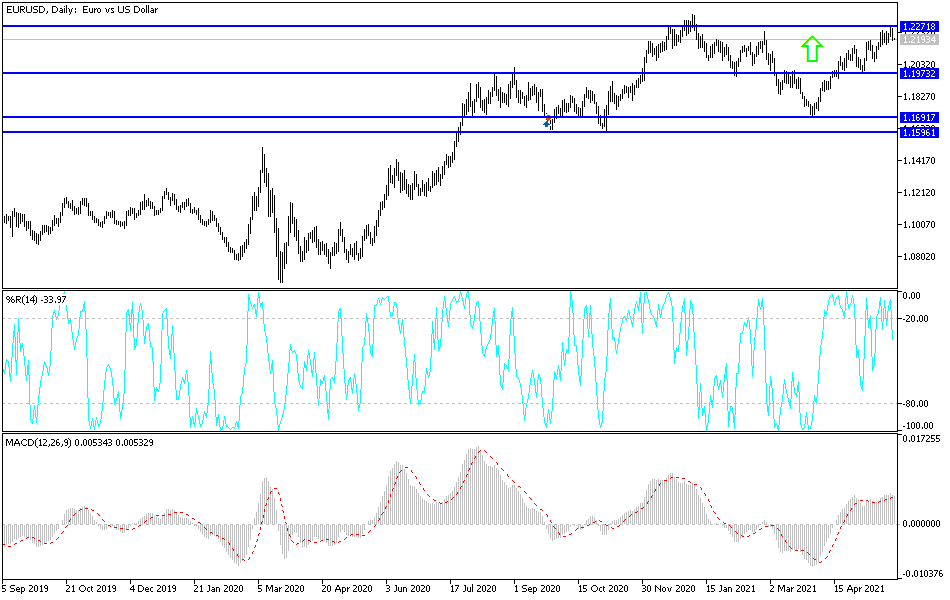

Strong successive gains pushed the EUR / USD currency pair towards the 1.2266 resistance level, the highest for the currency pair in more than four months. Its been mentioned that the pair is now preparing for profit-taking selling as the gains pushed technical indicators to overbought levels.

We noticed selling activity in the euro-dollar pair, reaching the support level of 1.2175 on Thursday and stabilized around the level of 1.2200, in anticipation of the announcement of a package of US economic data.

In general, improving supplies of coronavirus vaccines and the continued easing of restrictions last week paves the way to reopen the major eurozone economies and in this process help save prospects for the continent's economic recovery.

Commenting on the Euro’s performance, Kate Jokis, chief forex strategist at Société Générale said, “We cannot trust the euro to move until it is consolidated, and we really would like to have only symbolic opposition and support from the European Central Bank from good data and increased bond yields. So far, this is a weakly grounded step, even if it fits our point of view. The broader background is still negative for the dollar. ”

The reluctance on the part of investors and analysts to push the euro to achieve more comes at the beginning of trading in 2021. The pace of the strong gains in the euro was stopped due to concerns of the European Central Bank (ECB) about the impact of the 2020 rise on inflation expectations in the euro area. It wasn't long before the halting consolidation near highs in early January developed into a sweeping correction as the continent's vaccination defect became evident to everyone in the market, resulting in a loss of a quarter of the single European currency's gains.

Overall, the combination of these factors with the ECB's cautious assessment of current economic conditions and the outlook for the bloc's economy provides an accurate interpretation of what Societe Generale describes as a recovery that may be "painfully slow" at times.

This dynamic is reinforcing the already better opportunities elsewhere in the European neighborhood, although especially between the faster-growing Central and Eastern European economies (CEE) currencies that are usually more vulnerable to inflation, and so do the central banks that have a larger fleet than the central bank. European.

On the Coronavirus front, US health officials have granted emergency clearance for a third antibody drug to help reduce hospitalizations and deaths due to COVID-19. The US Food and Drug Administration said Wednesday that it has permitted the drug from GlaxoSmithKline and Vir Biotechnology for people with mild to moderate cases of COVID-19 who face additional risks of developing serious illness, including the elderly and those with underlying health problems.

There was low demand for two similar properties already available, mainly due to logistical obstacles to getting them and confusion over availability. In the United States, health officials are trying to raise awareness of treatments, and link people who have tested positive for COVID-19 with information about nearby service providers.

According to the technical analysis of the pair: Despite the recent selling moves, the general trend of the EUR / USD remains bullish, and the actual reversal of the trend will not occur without the currency pair moving towards the support levels of 1.2055 and 1.1975, respectively. On the upside, I still see that the breach of the resistance 1.2270 on the daily timeframe chart supports the strength of the bullish trend, and at the same time stimulates the technical indicators to move towards strong overbought areas. I still prefer to sell the currency pair from every upward level.

As for the economic calendar data today: The GFK German Consumer Climate reading will be announced. From the United States of America, the most important news will be the GDP growth rate, weekly jobless claims, durable goods orders and pending US home sales.