At the beginning of this week's trading, the EUR/USD pair continued its correction to the upside, with gains that reached the 1.2178 resistance level. The pair settled around 1.2130 at the beginning of trading on Tuesday. As is well known, the pair's recent gains were supported by the unexpected weakness of the US jobs numbers for the month of April, which negatively affected the US dollar against the rest of the other major currencies. The US Federal Reserve Bank (Fed) recently said that the US economy is still far from a full recovery and the inflation targets that the bank wants to achieve before making changes to its globally supportive monetary policy need to be met.

Commenting on this, ING analyst Chris Turner says, “This has likely eased some of the pressure on the Fed to switch to a less dovish rhetoric. At the same time, the loss of data was not enough to severely affect the underlying recovery story, leaving global risk sentiment broadly supported.”

The gains for the US job numbers were well below the nearly 1 million new jobs projected, but they still send a clear signal that US growth is recovering strongly enough to give a boost to other global economies.

This week is quiet in terms of important European economic data, so focus will be on the US inflation numbers for April and then the retail sales numbers, though neither of them can move the Fed off the low interest rate for a longer period than ever before. Fed policymakers have set high limits, including "substantial incremental progress" toward pre-pandemic employment levels and a stronger and more sustainable inflation rate than they sought to achieve with monetary policies before as prerequisites for changes in quantitative easing and interest rate policies.

Accordingly, many analysts argue that this is an argument against holding the dollar anyway, and even more so now given that the Eurozone and the rest of the global economy are tentatively showing signs of a turn higher, which doubly supports the euro and dollar outlook. Zach Pandel, Forex analyst at Goldman Sachs, says: “We continue to favor EUR/USD long positions as an expression of the broad decline in the dollar’s value, due to improving domestic fundamentals in the Eurozone. After a slow start, the European Union vaccination program is now going faster than we expected, and our global economy team now estimates that the European Union will match the United States by vaccinating 50% of the population around mid-June.”

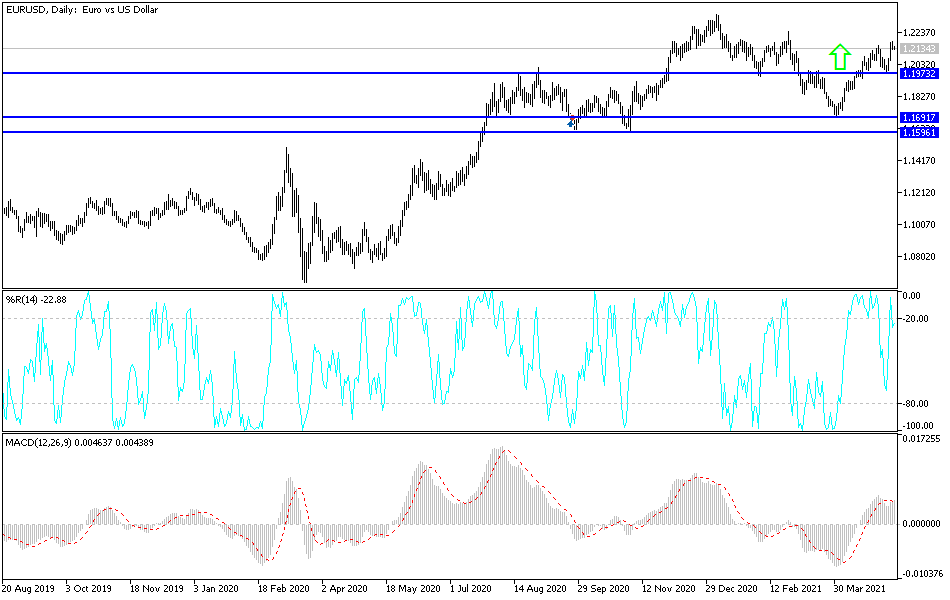

Technical analysis of the pair:

The general trend of the EUR/USD is still bullish despite the halting of its gain,s as long as the pair is stable above the 1.2000 resistance. The bulls are carefully watching vaccination developments in the United States, Europe and the situation in India, as well as economic figures after the reopening of European economies. The next target for bulls according to the performance on the daily chart is the resistance level at 1.2245. There will be no reversal of the general trend without breaching the 1.2000 support. I still prefer selling the EUR/USD currency pair from every upward level.

Today, the EUR will be affected by the release of the German ZEW Economic Sentiment reading.