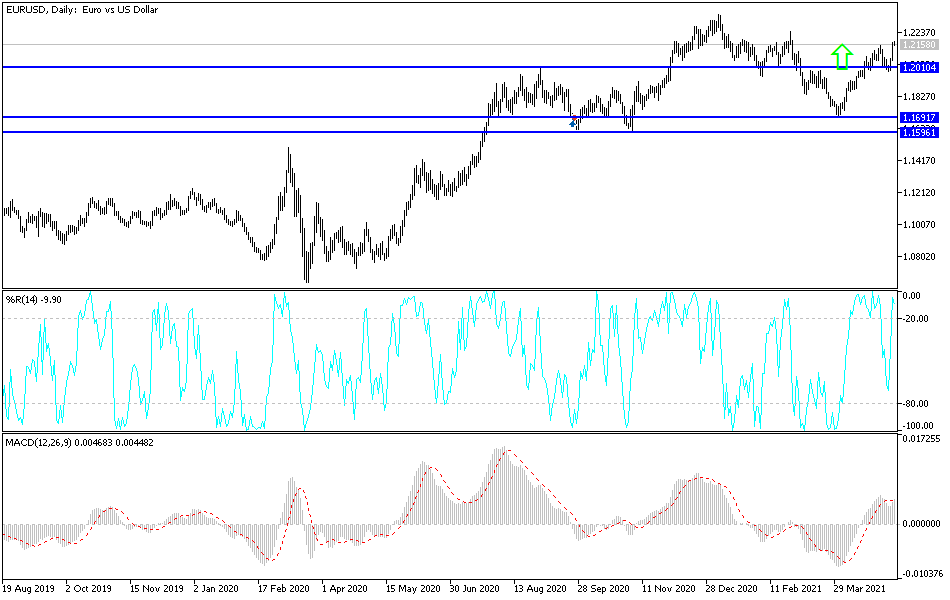

In a sudden development at the end of last week's trading, the EUR/USD moved strongly to the resistance level of 1.2172 where it closed the week’s trading. In the middle of the week's trading, it was moving downwards, reaching the support level of 1.1986. The pair's gains were a natural reaction to the release of disappointing US job numbers for April, which shook investor confidence in the economic performance.

European Union leaders have stepped up their criticism of the United States' call to waive patents for the COVID-19 vaccine, saying that this move will not result in a short-term or medium-term improvement in vaccine supplies and may have a negative impact.

On the second day of the EU summit in Portugal, European leaders instead urged Washington to lift export restrictions if it wants to have a global impact on the pandemic. In this regard, the President of the European Council, Charles Michel, said: "We do not believe, in the short term, that it is the magic bullet." For his part, French President Emmanuel Macron insisted that giving any priority now to discussing intellectual property rights “is a false debate”.

German Chancellor Angela Merkel went even further, warning that loosening patent rules could harm efforts to adapt vaccines to the mutation of the coronavirus. "I see more risks than opportunities," Merkel said. "And I don't think patenting is the solution to making vaccines available to more people.”

Instead, the leaders joined previous European Union calls for US President Joe Biden to begin boosting US vaccine exports as a way to contain the global COVID-19 crisis, insisting that the move was the most urgent need. Macron said: "It is clear that I urge the United States to put an end to the ban on exports of vaccines and vaccine components that prevent their production."

He pointed to the German company CureVac, saying that it could not produce a vaccine in Europe because the necessary ingredients are withheld in the United States. Hundreds of ingredients can be included in the vaccine. Merkel also said that she hopes that "now that large parts of the American population have been vaccinated, there will be a free exchange of (vaccine) components. "Europe has always exported a large part of its European (vaccine) production to the world, and this should become the norm," Merkel added.

While the United States of America kept a tight lid on exports of American-made vaccines so that it could vaccinate its population first, the European Union became the leading supplier in the world, allowing many doses to exit outside the 27-nation bloc and kept in a population of 446 million. The European Union has distributed around 200 million doses within the bloc while roughly the same amount has been exported abroad to nearly 90 countries. Britain, a former member of the European Union, behaved similarly to the United States.

Technical analysis of the pair:

The stability of the EUR/USD above the 1.2000 resistance supports the bulls' control over the performance and edges closer to the 1.2200 resistance. Hitting that level would confirm the direction of the technical indicators towards strong overbought levels, as shown on the daily chart. Accordingly, there may be profit-taking selling at the resistance levels of 1.2190, 1.2255 and 1.2330. On the downside, there will be no first reversal of the trend without breaching the 1.2000 support. Otherwise, the general trend of the currency pair will remain bullish.

Today, the pair is not awaiting any important US data. Only the Sentix Investor Confidence Index in the Eurozone will be announced.