The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a fairly good time to be trading markets right now, as there are a couple of valid long-term bullish trends in favor of the Canadian dollar and gold against the U.S. dollar.

Big Picture 23rd May 2021

Last week’s Forex market saw the strongest rise in the relative value of the Japanese yen and the strongest fall in the relative value of the New Zealand dollar. However, the fluctuations were small, so this is not a very significant fact.

I wrote in my previous piece last week that the best trades were likely to be long of the S&P 500 Index, short of the USD/CAD currency pair, and long of gold in USD terms. The S&P 500 Index closed the week down by 0.34%, the USD/CAD fell by 0.29%, while gold rose by 2.04%. This produced an averaged win of 0.66%.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week was the U.S. Federal Reserve’s apparent new willingness to discuss tapering of its asset purchase program, at least in private. This was revealed in the FOMC meeting minutes release, but in truth, although this was the major news in the Forex market last week, it did not have a major impact. We are seeing a mixed picture across markets, with fewer clear trends surviving. The precious metal gold is strong, while the Canadian dollar has the greatest long-term strength of any major currency. The U.S. dollar remains weak.

The main events this coming week will be releases of preliminary U.S. GDP data plus testimony from the Bank of England before Parliament and the monthly policy release from the Reserve Bank of New Zealand.

Last week saw the global number of confirmed new coronavirus cases fall for the third week running, suggesting that the recent wave which saw a new record daily high has probably peaked globally. It is likely that the vaccination campaign seen mostly in more advanced economies has contributed significantly to this situation. Total confirmed coronavirus deaths remained roughly the same last week as the previous week.

Many countries have begun vaccination programs. Excepting extremely small nations, the fastest progress towards herd immunity has taken place in Israel, the U.K. and the U.A.E. Immunization is now proceeding more quickly in the European Union than it is in the U.S. although the U.S. is ahead of the E.U. with 48% of its population having received at least one shot of a vaccine, while the E.U. has vaccinated 34% of its population.

The strongest growth in new confirmed coronavirus cases right now is happening in Argentina, Bahrain, Belarus, Bolivia, Brazil, Chile, Cuba, Dominican Republic, Egypt, Malaysia, Oman, Paraguay, Sri Lanka, Taiwan, Trinidad, Uruguay, and Vietnam.

Technical Analysis

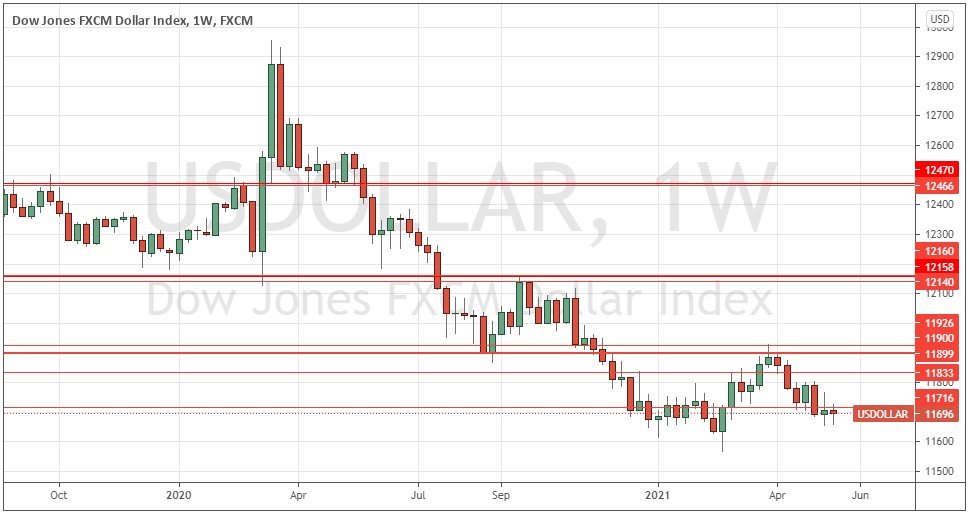

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed an indecisive though perhaps slightly bearish doji candlestick last week. The index is still below its price from six months ago, which is another a bearish sign, but is now above its price from three months ago, which makes the picture more uncertain. Overall, next week’s price movement in the U.S. dollar looks very slightly more likely to be downwards than upwards but remains very uncertain.

USD/CAD

Although the Canadian dollar does not have a good track record of respecting its own price momentum, the chart below shows we have seen a firm and persistent long-term bullish trend in the Loonie ever since the initial recovery from the coronavirus price shock of March 2020. Last week again saw a bearish candlestick print, with this currency pair now making a new 3.5-year low price. We can therefore say there is a strong long-term bearish trend, although bears should be cautious of the big round number at 1.2000.

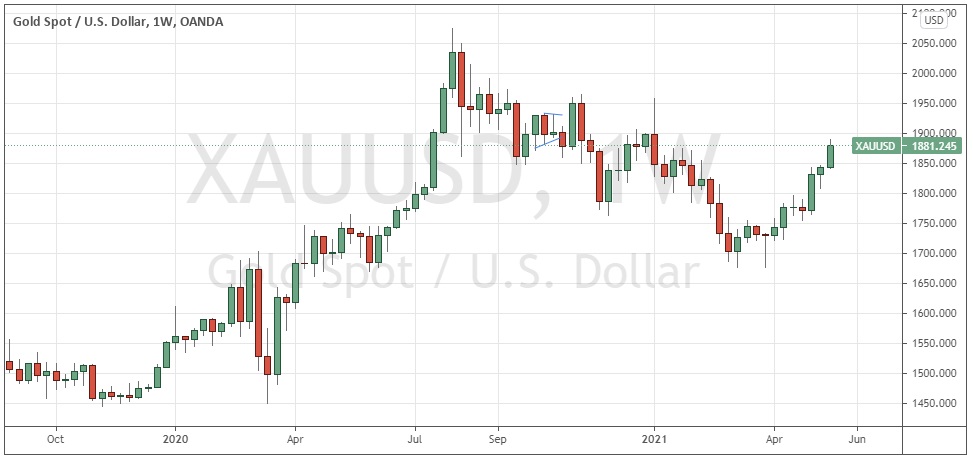

Gold

Gold again saw a firm advance during the week to reach a new 50-day high price and end the week near the top of its weekly price range. The price is now considerably higher than it was 3 months ago, which is normally a good measure of a bullish trend. Although the breakout here is not especially strong, gold does have a good historical record on the long side when it begins to break to new long-term highs.

Bottom Line

I see the best likely opportunities in the financial markets this week as being short of the USD/CAD currency pair, and long of gold in USD terms.