The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is not an especially good time to be trading markets right now, as there are only a few valid long-term trends to exploit, most notably the bullish trend in bold against the U.S. collar.

Big Picture 30th May 2021

Last week’s Forex market saw the strongest rise in the relative value of the New Zealand dollar and the strongest fall in the relative value of the Japanese Yyn.

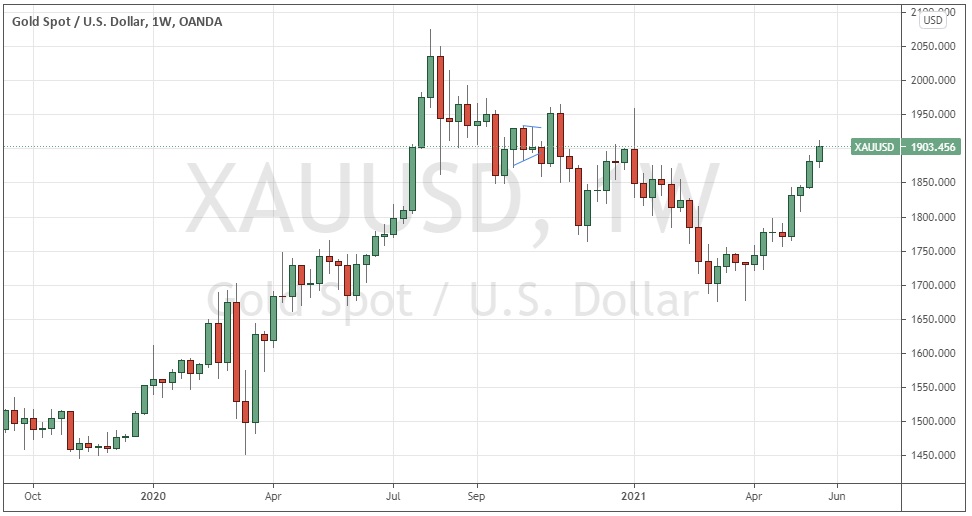

I wrote in my previous piece last week that the best trades were likely to be long of gold in USD terms and short of USD/CAD. Gold in USD terms rose by 1.18% over the week, while the USD/CAD currency pair rose by 0.08%. This produced an averaged win of 0.55%.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week was the continuation of risk appetite although it has become considerably more muted as fears of resurgent inflation increase, especially concerning the U.S. economy. We are seeing a mixed picture across markets, with fewer clear trends surviving. The precious metal gold remains strong, while the Canadian and New Zealand dollars have the greatest long-term strength of any major currency – commodity currencies are generally strong. The Japanese yen is the weakest major currency.

Last week saw the Reserve Bank of New Zealand take a more hawkish tilt in its monetary policy, which has probably helped the Kiwi to remain strong. Technically, it is one of the strongest major currencies, so it may be a buy according to both technical and fundamental analysis.

The main events this coming week will be releases of U.S. non-farm oayrolls data plus the Reserve Bank of Australia’s rate statement and Australian GDP data. This suggests that the USD (Thursday and Friday) and the AUD (Tuesday and Wednesday) are likely to experience volatility over this coming week.

Last week saw the global number of confirmed new coronavirus cases and deaths fall for the fourth week running, suggesting that the recent wave which saw a new record daily high has peaked globally. It is likely that the vaccination campaign seen mostly in more advanced economies has contributed significantly to this situation.

Many countries have begun vaccination programs. Excepting extremely small nations, the fastest progress towards herd immunity has taken place in Israel, the U.K. and the U.A.E. Immunization is now proceeding more quickly in the European Union than it is in the U.S. although the U.S. is ahead of the E.U. with 50% of its population having received at least one shot of a vaccine, while the E.U. has vaccinated 37% of its population.

The strongest growth in new confirmed coronavirus cases right now is happening in Afghanistan, Algeria, Bahrain, Bhutan, Bolivia, Cambodia, Chile, Colombia, Dominican Republic, Haiti, Malaysia, Paraguay, Saudi Arabia, Sri Lanka, Taiwan, Trinidad, U.A.E., Venezuela, and Vietnam.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed an indecisive though perhaps slightly bullish doji candlestick last week. However, there are still several bearish signs, most notably the fact that the price action is still respecting the resistance level identified at 11716. The index is still below its prices from both six and three months ago which shows a long-term bearish trend persists in the greenback. Overall, next week’s price movement in the U.S. dollar looks very slightly more likely to be downwards than upwards but remains uncertain. Much is likely to depend upon whether the resistance level at 11716 holds.

USD/CAD

Although the Canadian dollar does not have a good track record of respecting its own price momentum, the chart below shows we have seen a firm and persistent long-term bullish trend in the Loonie ever since the initial recovery from the coronavirus price shock of March 2020. Despite the strong long-term bearish trend, bears should be cautious of the big round number at 1.2000 which has yet to be reached. Bears should also be cautious of the fact that last week’s price range was very narrow, so it will probably be worth waiting for the price to get established below both the low and the big round number at 1.2000.

Gold

Gold again saw a firm advance during the week to reach a new 50-day high price and end the week near the top of its weekly price range. The price is now considerably higher than it was 3 months ago, which is normally a good measure of a bullish trend. Although the breakout here is not especially strong, gold does have a good historical record on the long side when it begins to break to new long-term highs.

USD/TRY

The Turkish lira for years now has suffered from an established status as a permanently weakening basket case of a currency as markets have little confidence in the ability of the Turkish central bank to operate appropriately. Last week, the currency made another all-time low before this currency pair ended the week at a record high weekly close.

This currency pair makes a tempting target, but spreads and overnight financing fees are high so it should only be traded with caution. The price is also often prone to strong bearish retracements which happen very suddenly. Traders looking to be short of the Turkish lira need to be extremely careful and pick their timing precisely.

USD/ZAR

Although the South African rand does not have a good track record of respecting its own price momentum, the chart below shows we have seen a firm and persistent long-term bullish trend in the rand ever since its initial recovery from the coronavirus price shock of March 2020. There is a strong long-term bearish trend, with healthy bearish momentum over the price week pushing the price down to a new 2-year low price. The price of this currency pair looks likely to fall further over the coming week.

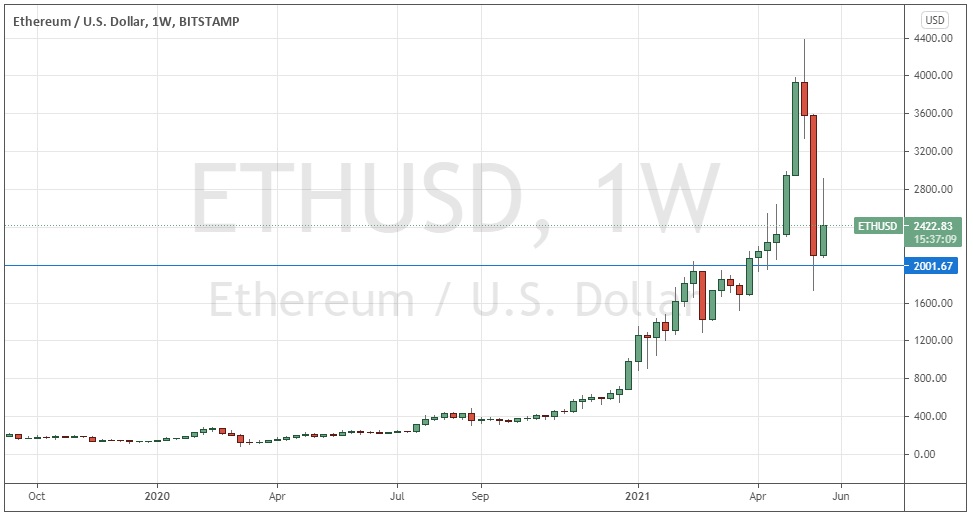

Ethereum

Although some analysts believe we have seen a bursting of a cryptocurrency price bubble over the past couple of weeks, the relative strength of Ethereum has become notable, as it led the earlier advance rather than Bitcoin, and held up better technically during the subsequent crypto decline.

Technically, we see an obvious pivotal area of likely support confluent with a major round number at $2,000. If this level continues to hold, it may provide an area of good value in which to take a medium to long-term long trade in Ethereum against the USD.

Bottom Line

I see the best likely opportunities in the financial markets this week as being short of the USD/CAD and USD/ZAR currency pairs, and long of gold in USD terms. There may also be short-term opportunities in long trades in the JPY crosses with commodity currencies and the British pound.