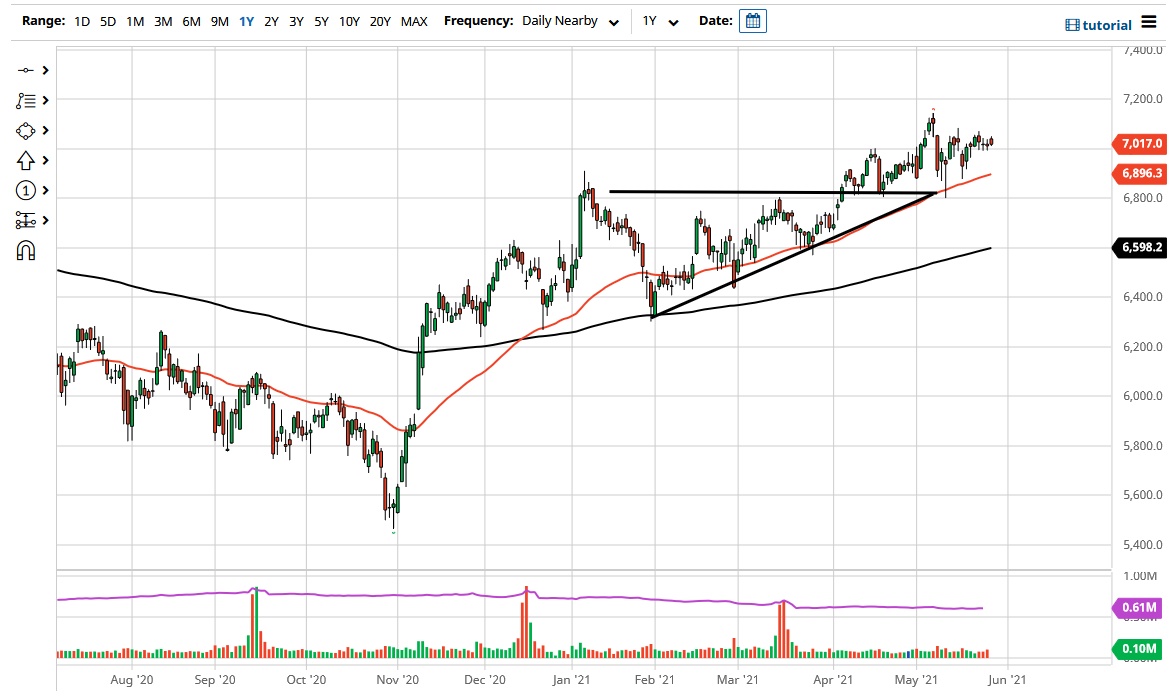

The FTSE 100 has been hanging out just above the 7000 level for about a week now, and it shows no signs of breaking out quite yet. That being said, we are very much in an uptrend, so it makes sense that we will eventually continue that move. The 50-day EMA is rising in a direct path from where the uptrend line from the ascending triangle sits, so I think both moving average and trendline traders will be attracted to that vicinity.

Furthermore, we may have to sit around and wait to decide whether or not the global reopening trade continues to propel markets, and if it does, it would make sense that the FTSE would be one of the beneficiaries. After all, we had seen a massive amount of damage to everything British related during Brexit and the time after, so I think at this point there is still value to be found here. If we can break out to the upside, it is likely that we will go looking towards the 7200 level, which is the next psychologically important level from what I can tell. After all, the market, much like its cousin in the United States the S&P 500, tends to move in 200-point increments.

To the downside, I believe that the 6800 level should offer support, as it was the top of the ascending triangle previously. If we were to break down below there, then I think we could go looking towards the 200-day EMA, which is currently stationed just above the 6600 level. Breaking that could open up even more negativity, and at that point I might actually be a seller. As a general rule, though, I do not have any interest in trying to short indices right now, because central banks around the world are far too loose with monetary policy to try to fight the inflation hedge that stocks are.

Ultimately, I am a buyer of dips, but I also realize that you are going to have to be relatively patient in order to take advantage of the proclivities of the market. If you can be a patient trader and think more along the lines of an investor, buying this index should pay off in the end, but that does not mean it will happen in your timeframe.