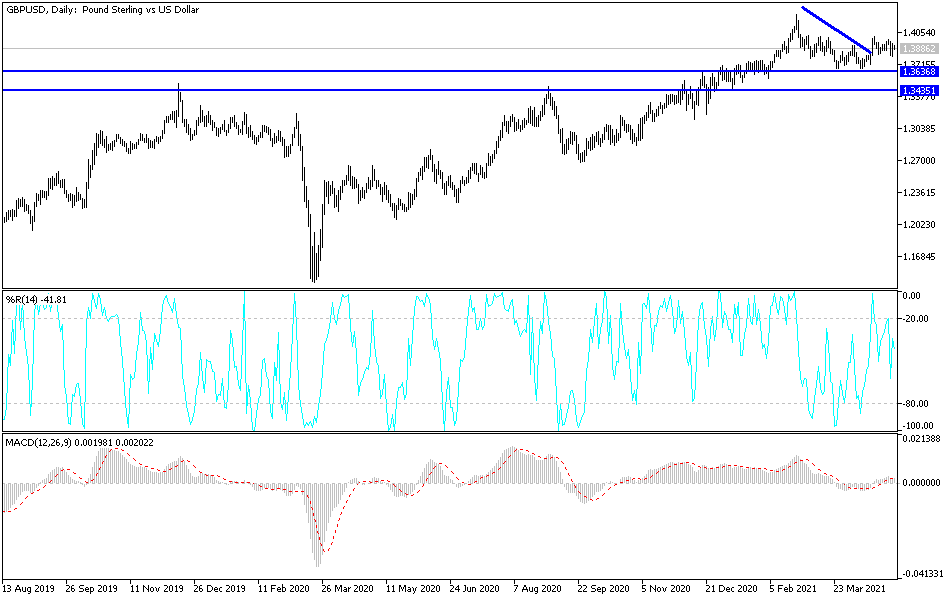

The British pound bounced hard from the 50-day EMA during the trading session on Monday as the US dollar found itself on its back foot to kick off the week. Furthermore, there was a downtrend line that also has offered support, and now it looks like we are going to continue to grind back and forth in order to try to build up enough momentum to take out the 1.40 handle above that has been so difficult. If we were to take out that level, then it is likely we could go looking towards 1.42 handle, but it is going to be difficult to make that move.

If we were to somehow break above the 1.42 handle, it would represent the British pound's takeoff towards the 1.45 handle, and although it has been very choppy over the last couple of months, you can take a look at this chart from a longer-term standpoint and recognize that we have been working the froth off the massive move higher, something that you would expect after a somewhat parabolic move.

If we do break down a bit from here and clear the double bottom underneath, we could open up the move down to the 1.35 handle underneath, which is where the 200-day EMA comes into play. The 200-day EMA obviously has a lot of effect on the overall trend in attitude when it comes to the trend, so with that being the case it is likely that we will see a lot of buyers jump in at that point. If we were to clear that move to the downside, that would be extraordinarily negative for the British pound, perhaps opening up massive losses and a major trend change. I do not see that happening in the short term, but it is always a possibility if there is a sudden “risk off” type of scenario.

Keep in mind that the UK economy has been trying to reopen, and if it does, this should continue to help the British pound. Remember, the United Kingdom has been seeing coronavirus numbers drop quite radically, and Forex traders have been looking at the currency markets through that prism as well. With that being said, I do think that we will eventually build up enough momentum to break out; but right now, we are most certainly struggling with the idea.