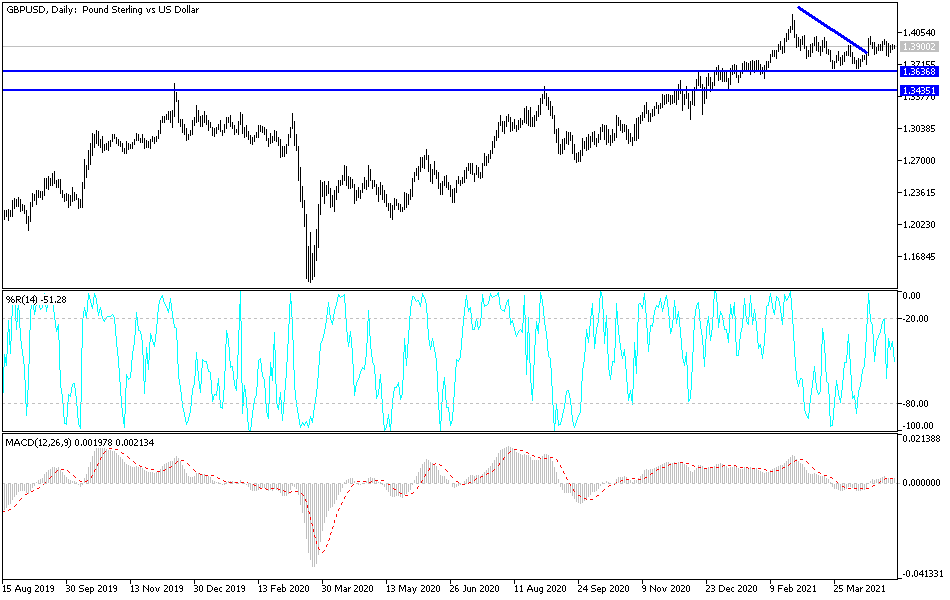

The British pound rallied during the trading session on Wednesday but gave back the early gains. This makes sense, because traders are waiting on the Monetary Policy Committee decision and statement during the Thursday session. With this, it does look like we are somewhat bullish, but we also have to keep in mind that there is still a massive barrier just above at the 1.40 handle. Because of this, the market is likely to continue to try to build up enough momentum to break above that level. Whether or not it can is a completely different question, but it clearly would be a major victory for the bulls.

Underneath, we have the 50-day EMA sitting at the 1.3833 handle, and I think that will continue to offer a significant amount of support. Underneath that, we also have the previous downtrend line that should now be support, and eventually we have the double bottom that is sitting near the 1.37 handle. It is not until we break down below there that I think we would have to worry about the overall uptrend, and right now I think we are still trying to form a bit of a basing pattern. That being said, if we do break down below the double bottom, then it is likely that we are going to see a run down to the 200-day EMA, essentially sitting at the 1.35 large, round, psychologically significant figure.

To the upside, if we can finally get a daily close above the 1.40 handle, then it opens up the move to the 1.42 level that I think longer-term traders are looking for. Clearing that level then allows the British pound to go looking towards 1.45 handle. Remember, even though this market has rallied quite significantly over the last several months, at least until recently, it still somewhat historically cheap and, with the US dollar on its back foot, I think we will continue to see more upward pressure given enough time. This is unless we see some type of massive “risk off event” which is always possible. With the reflation trade coming back into vogue, the US dollar should continue to be on its back foot going forward - at least that is the theory - and that is the narrative making the rounds right now.