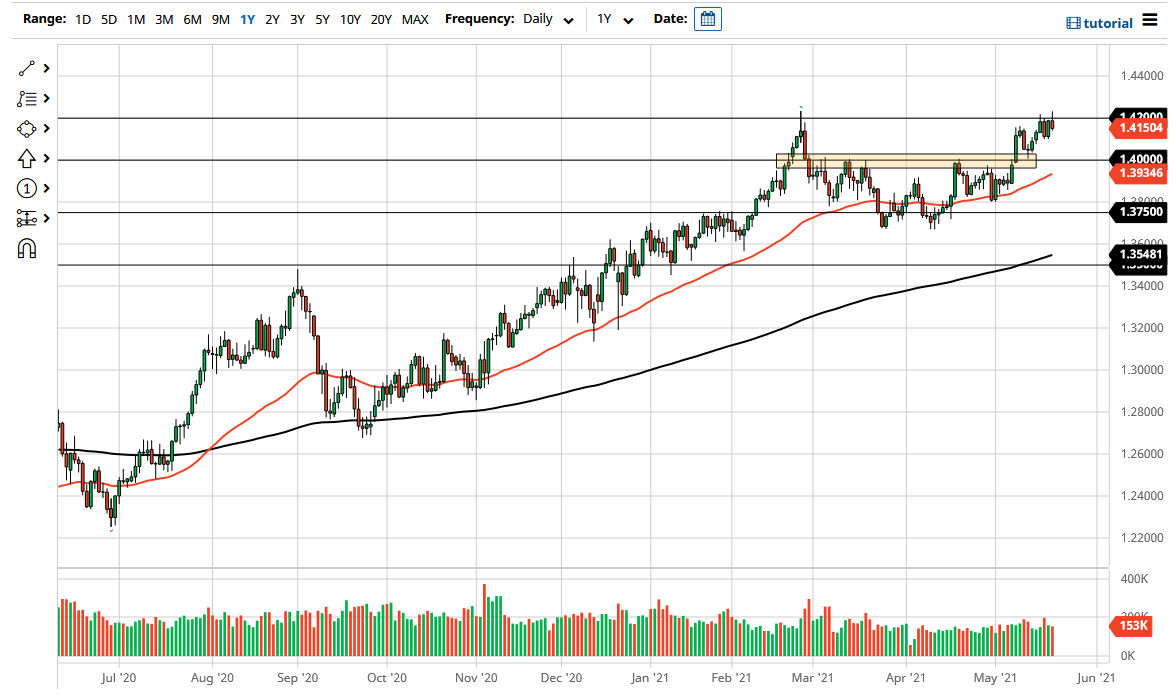

The British pound initially tried to rally during the trading session on Friday after a stronger-than-anticipated retail sales number in the United Kingdom. In fact, it was the strongest number since 1987, so the pound got a boost initially, but as you can see, by the end of the day we turned around completely to show signs of exhaustion. The 1.42 level continues to be a major barrier that the market simply does not seem to be able to stay above.

There is a lot of information here on this chart that can influence where we go next. If we break above the highs of the Friday session, then it would be a significant sign that the market is ready to go much higher, perhaps reaching towards the 1.45 level. At this point, the market is likely to see a lot of resistance, but we also have a massive amount of support underneath. As you can see, I have a rectangle at the 1.40 handle, an area that I think will continue to attract a lot of attention as it has in the past. The market continues to see a lot of support there going forward from what I can tell, as it had been so resistant previously. Furthermore, the 50-day EMA is approaching that area, so that adds even more credence to that region as a significant support level.

That being said, I do not know that we will even get down to there. The 1.41 handle has also offered support recently, and it is worth noting that we have been grinding higher. When you look at the action of the market over the last three or four months, we have come full circle, suggesting that we have worked off quite a bit of froth that needed to be done. Because of this, I think it is only a matter of time before we continue the move to the upside. The market breaking down below the 1.40 level would perhaps put negative pressure on the pair, but right now it certainly seems as if the real pressure is on the US dollar in general. With that in mind, I believe that we will get an opportunity to get long of this market based upon value, as pullbacks will almost certainly be bought.