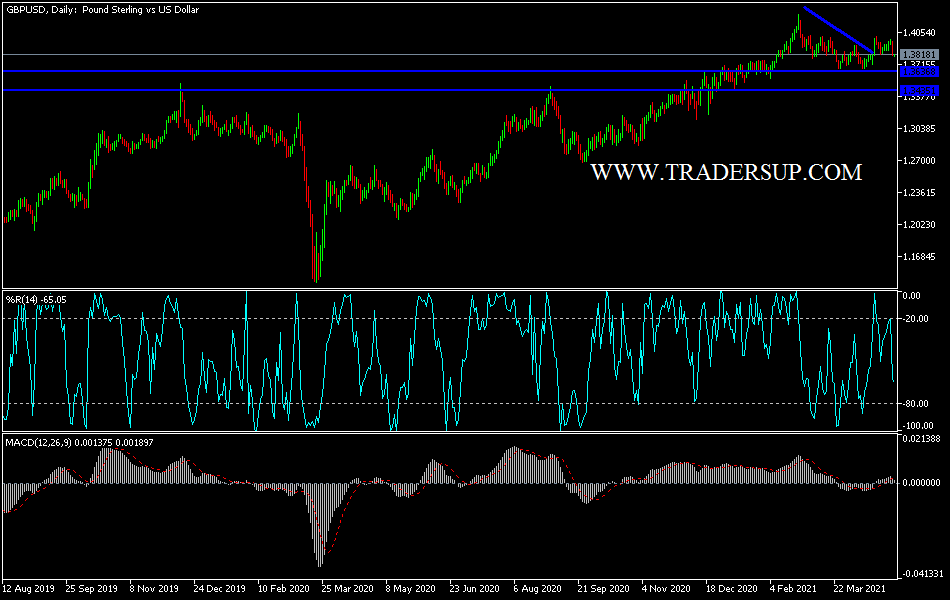

The British pound broke down significantly during the Friday trading session to reach down towards the 50-day EMA. The 50-day EMA is a technical indicator that a lot of people will pay close attention to, as it could offer a bit of dynamic support and resistance along the way. That being said, I think the market is likely to continue to find buyers, as this candlestick is negative, but it is not a complete breakdown.

The double bottom that sits just below the 1.2750 level also offers support, just as the 1.35 handle will as the market has been in an uptrend for quite some time. With this being the case, it is very likely that we will continue to see buyers trying to jump in based upon value. The US dollar continues to suffer longer term, and I think the pullback at this point will only attract more money.

In fact, I have no interest in shorting this market until we break down below the 1.35 handle, something that does not look likely to happen anytime soon. After all, that double bottom underneath current trading is very supportive, and it will take a significant amount of momentum to make that fall apart. On the other hand, you should take a look at the 1.40 level as a massive resistance barrier, because the market has had quite a bit of trouble to break up above that level. If we were, that opens up a move towards the 1.42 handle, which has been a massive barrier previously. If we were to clear that, then the market is likely to go looking towards the 1.45 handle, but I do not see that happening anytime soon. I think more likely than not we will have choppy behavior in a sideways market with an upward tilt.

If we were to break down below the 1.35 handle, then I think that opens up a huge move lower, as it could trigger the end of the overall uptrend. That seems to be very unlikely, but it is something to keep in the back of your mind as a potential move if we suddenly get a massive “risk off” type of environment that has people driving back into the greenback.