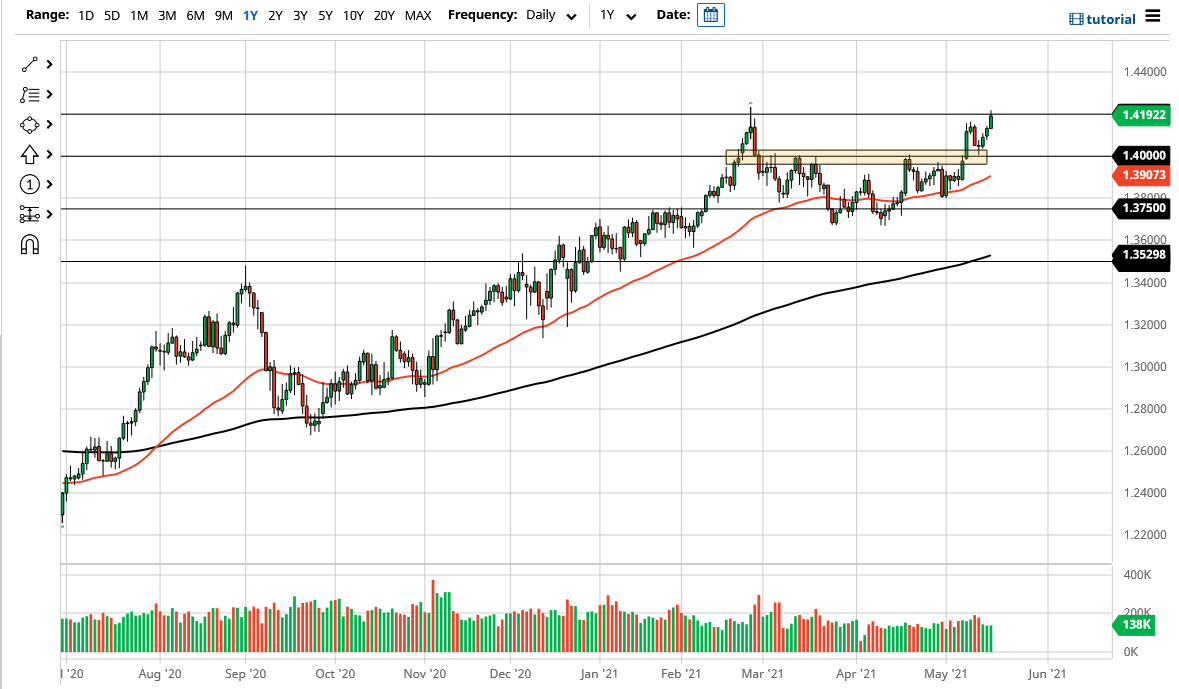

The British pound rallied again during the course of the trading session on Tuesday to test the 1.42 level. This is an area that has been important more than once, as we had tried to break above there during the month of February. The fact that we could not break out to the upside and make a fresh, new high during the day was not a huge surprise, because this was always going to be a difficult area to overcome.

That being said, the market certainly looks as if there is plenty of support underneath that should come into play. I think at this point it is likely that the 1.40 level offers a bit of a short-term “floor in the market”, as it was previous resistance. The fact that we have broken above it certainly shows a proclivity to go higher, but that does not necessarily mean that we have to break out rapidly.

I think the best way to trade this market is to look for short-term pullbacks, as the US dollar is clearly working against several currencies. Beyond that, the United Kingdom is starting to reopen, so there should be a bit of a shot higher when it comes to the British pound overall. Between that, and the trouble that we are seeing with the US dollar in general, I think it is only a matter of time before we do break out. On the breakout, I believe that this market could go looking towards the 1.45 level over the next several weeks, as it would be a continuation of the overall uptrend that we had seen for some time.

The US dollar may occasionally find a bit of a bid, but at the end of the day it still continues to suffer at the hands of the Federal Reserve and its loosening monetary policy. With this being the case, the market is likely to continue to see buyers and value hunters every time we dip. I have no interest in shorting, but if we did break down below the 1.40 handle it is likely that we would see the 50-day EMA come into play as it should offer dynamic support as it has multiple times in the past. Regardless, I do not have any interest in trying to short this market, it has been far too strong for far too long.