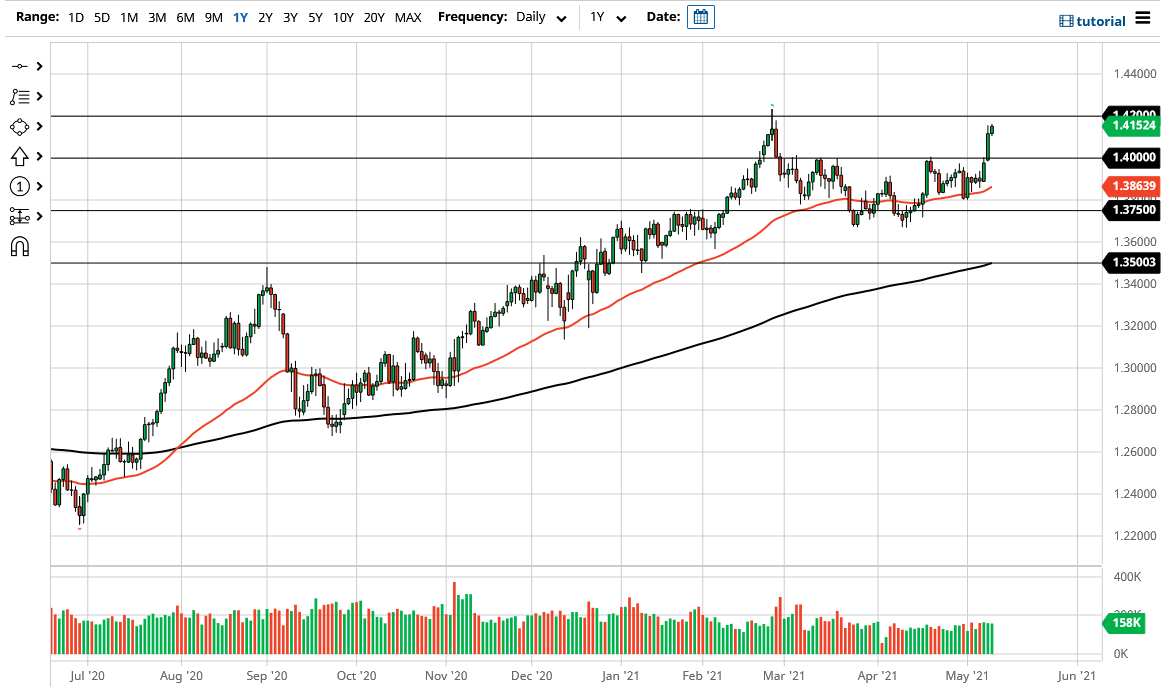

The British pound has rallied a bit during the course of the day on Tuesday, as we are reaching towards the 1.42 handle again. The 1.42 handle is an area where we had seen a lot of resistance previously, so now it is a simple matter of waiting to see whether or not we can break that level if we get a daily close above the 1.42 handle, then I do think that we go much higher, perhaps reaching towards the 1.45 handle.

In the short term, I think that it is only a matter of time before we would find buyers underneath near the 1.40 handle, which is an area that will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, and an area where we had recently seen a lot of resistance. With that being the case, I think there will be a lot of buyers near the 1.40 level as a short-term “floor the market.”

I would not be surprised at all to see a little bit of a short-term pullback in order to build up enough momentum to finally take out to the upside the resistance and go much higher. Ultimately, if we break down below the 1.40 level then we are likely to go looking towards the 50 day EMA. The 50 day EMA is an area that people will pay close attention to as it has offered quite a bit of support over the last several weeks and is starting to curl higher. Think of this as dynamic support going forward, and of course after that we have the 1.3750 level where we have formed a bit of a double bottom recently. In other words, there are plenty of areas where the British pound should find buyers, and therefore I think it is only a matter of time before we should find plenty of value hunters coming into this market and taken advantage of what has been an obvious trend. Furthermore, the United States dollar has been signed in for quite some time, and therefore it makes the most sense to look for value going forward. I have no interest in shorting this pair, it has clearly made an argument for a potential break out coming sooner rather than later.