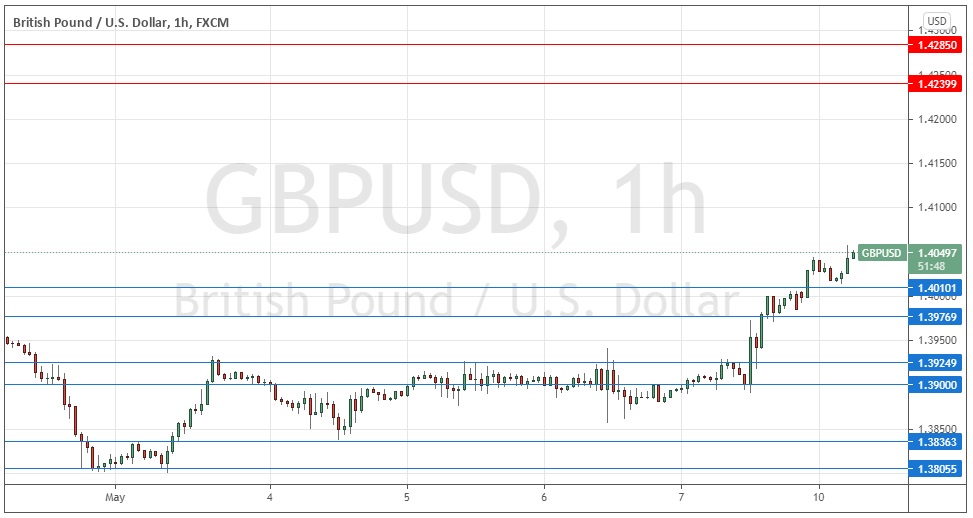

Last Wednesday’s GBP/USD signals produced a short trade from the early bearish reversal at 1.3925, but the trade barely broke even as there was no downwards momentum after the entry.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be taken prior to 5pm London time today only.

Short Trade Ideas

- Go short with a limit order immediately upon the next touch of 1.4240.

- Use a volatility-based stop loss.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4010 or 1.3977.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Wednesday that the price was in a wide consolidation between about 1.4000 and 1.3800 with a bearish tilt. Therefore, I was looking for a short trade from a bearish reversal at any of the key resistance levels. This trade did set up but did not really go anywhere and only broke even.

The technical picture has changed considerably since last Wednesday, as the U.S. dollar fell strongly at the end of last week against every major currency. The fall against the British pound was not the strongest, but the price rise has still been firm enough to push the price above the long-term resistance and psychological level at approximately 1.4000. The price is now rising over the short term at a new 50-day high after a bullish breakout, so the picture and outlook are clearly bullish. However, the price has been higher than its current price when it rose a few weeks ago as high as the 1.4200 area, so it is arguably not truly in blue sky yet and could be prone to meeting sudden resistance. Nevertheless, I think we are likely to see higher prices over the course of today and possibly over the rest of this week. There are no important news events scheduled today likely to impact this pair or any of the major pairs in the Forex market, making a price rise today slightly more likely.

This pair could be attractive for day traders today looking for short-term long trades.

There is nothing of high importance due today concerning either the GBP or the USD.