Bullish View

- Buy the GBP/USD and add a take-profit at 1.4250.

- Add a stop-loss at 1.4100.

- Timeline: 1 day.

Bearish View

- Set a sell-stop at 1.4130 and a take-profit at 1.4050.

- Add a stop-loss at 1.4176.

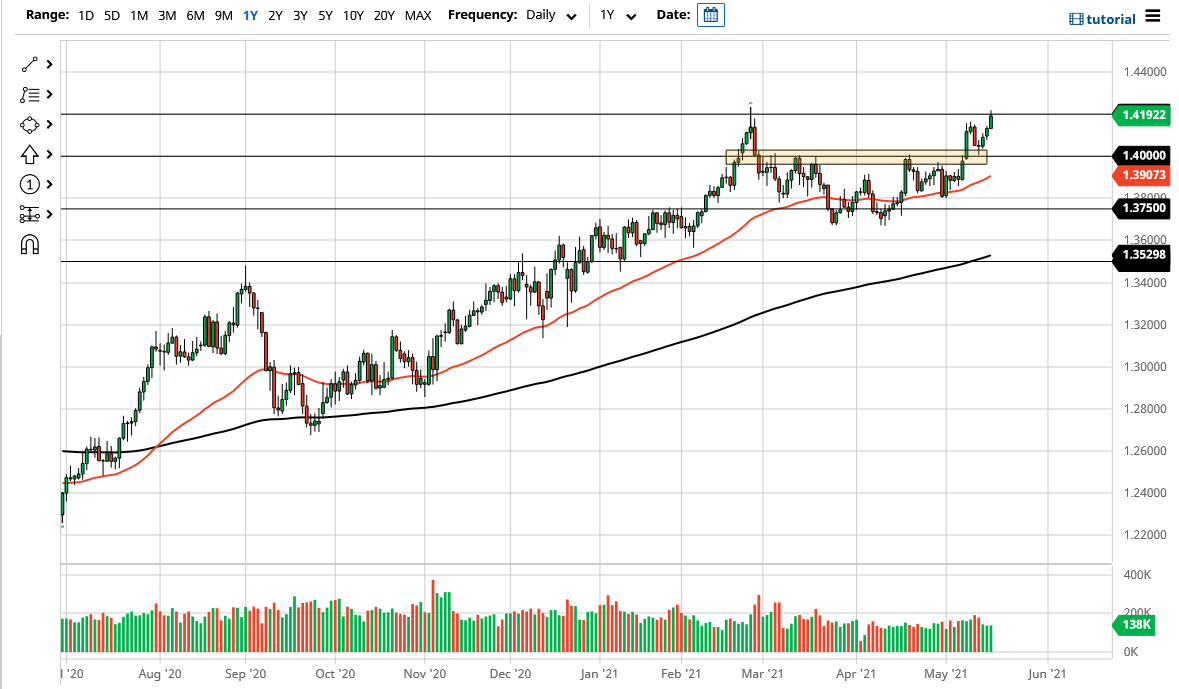

The GBP/USD rose above a key resistance level ahead of the upcoming UK employment and American housing starts data. It is trading at 1.4176, which is 2.67% above the lowest level this month.

UK Jobs Numbers Ahead

The Office of National Statistics (ONS) will publish the March jobs numbers in the morning session today. Economists expect the data to show that the labour market continued doing well in March as the country started easing its lockdown measures.

In total, economists expect the data to show that the unemployment rate declined from 4.9% in February to 4.8% in March. This will be a good figure than in comparable countries like the United States, where the unemployment rate was at 6.0% in March. This performance is mostly because of the government’s furlough program that will continue until September this year.

Meanwhile, analysts expect that the number of people filing for unemployment benefits will fall while wages will rise. Precisely, they see the average earnings ex-bonus rising by 4.6% in March. With bonus, they see it rising by 4.5%.

In general, the UK’s economy has been relatively strong because of the actions by the Bank of England (BOE) and the government. The BOE has slashed rates and launched a major quantitative easing drive while the government has provided billions of pounds in support. It also reached a Brexit deal with the European Union in December.

The GBP/USD will also react to the latest housing starts and building starts data from the United States. The data is expected to show that housing starts declined from more than 1.739 million in March to more than 1.71 million in April. In the same period, they see the number of building permits rising from 1.75 million to 1.77 million.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD rose to 1.4165 last week. It then retreated and hit the important suppprt at 1.400 on Friday. This was a notable level since the pair had struggled moving above it several times before. The pair them rebounded and moved above last week’s high of 1.4615 in the overnight session. This is a sign that bulls have prevailed. It has also moved above the 25-day and 15-day moving averages. Therefore, the pair may keep rising as bulls target the next resistance at 1.4250.