Bearish View

- Set a sell-stop at 1.4050 and a take-profit at 1.3980.

- Add a stop-loss at 1.4100.

- Timeline: 1 day.

Bullish View

- Set a buy stop at 1.4100 and a take-profit at 1.4170.

- Add a stop-loss at 1.4000.

The GBP/USD price retreated after the strong US consumer inflation numbers. It fell to a low of 1.4050, which was the lowest level since May 10.

US Inflation Rises

The GBP/USD declined after the US published strong consumer inflation numbers. The headline CPI rose from 0.6% in March to 0.6% in April. This led to an annualized gain of 4.2%, the highest figure since 2008. Core CPI that excludes the volatile food and energy products rose from 0.3% in April to 0.9% in May and by an annualized rate of 3.0%.

The higher consumer inflation data means that the Fed could be forced to change its timeline for tightening faster than expected. A faster timeline of tightening will be bullish for the US dollar.

Later today, the statistics agency will publish the latest Producer Price Index (PPI) data. Analysts expect these numbers to show that the PPI rose by 5.9% in April since the prices of most commodities have recently surged. The core PPI is expected to rise by 3.7% from 3.1% in the previous month.

The GBP/USD will also react to the latest initial jobless claims numbers. Last week, data by the Bureau of Labor Statistics showed that the total number of initial claims declined from 498k. That was the first time it moved below 500,000 since the pandemic started. The data will come a few days after the US published the relatively weak employment numbers.

On Wednesday, the GBP/USD also reacted to the strong economic data from the UK. According to the Office of National Statistics (ONS), the economy bounced back by 2.1% in March as the country started to reopen. During the month, the manufacturing, industrial, and construction output rose at the fastest pace since the pandemic started.

GBP/USD Forecast

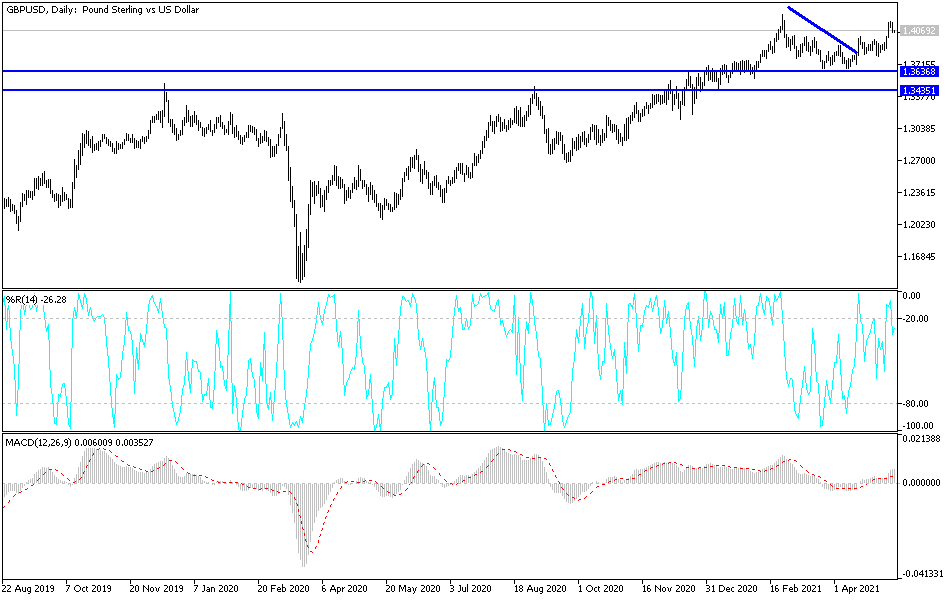

On Monday, the GBP/USD pair jumped above the important resistance at 1.4000 after the Scottish parliamentary election. It rose to a high of 1.4170, which was the highest level since February 25. Yesterday, the pair moved below the lower side of the bullish flag pattern that started to form on Monday after the strong data from the United States.

The pair is slightly above the support at 1.4000 and the 50-day moving average. Therefore, there is a possibility that it will keep falling as bears attempt to retest 1.4000 ahead of the PPI data. However, a relief rally could see it attempt to retest its highest level this week.