Bullish View

- Buy the GBP/USD as it consolidates.

- Add a take-profit at 1.4266 (R3) and a stop loss at 1.4060 (R1).

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.4060.

- Add a take profit at 1.4000 and a stop-loss at 1.4100.

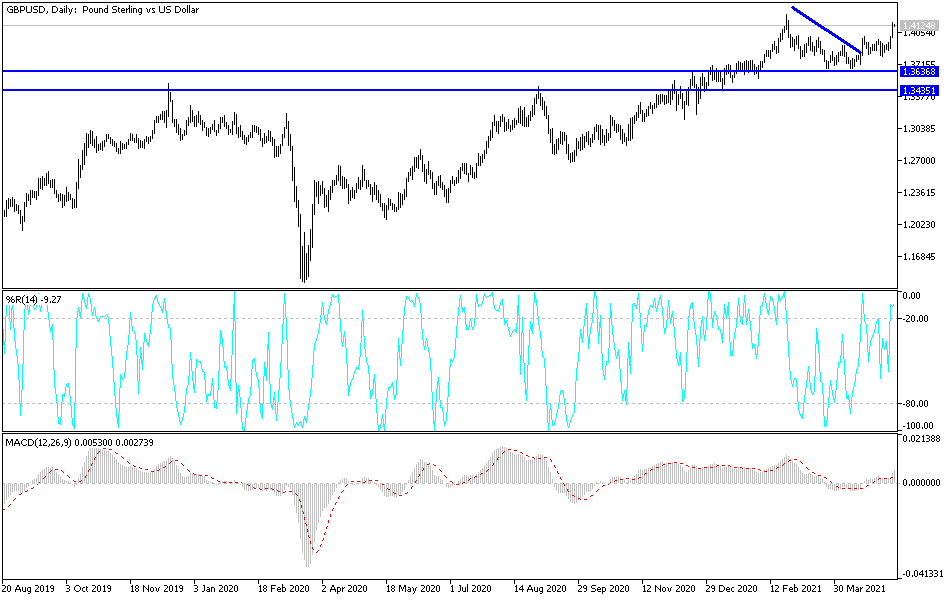

The GBP/USD price has been on a strong momentum in the past few days as demand for the pound rose. The pair has risen to 1.4126, the highest level since February. Similarly, sterling has gained against other currencies like the euro, Australian dollar and Swiss franc.

Scotland Referendum

The GBP/USD rose partly because of the just-concluded parliamentary election in Scotland. The Scottish National Party (SNP) fell short of the required majority that was needed to call for a referendum. However, the party will likely receive support from the eight members of the Green party to call for another independence referendum.

In the past 2015 referendum, most people voted to remain in the United Kingdom. However, recent opinion polls show that the sentiment has changed, with those preferring independence rising. The main concern among many young Scottish nationals is on Brexit since most people in Scotland voted to remain in the European Union. In general, an independence vote would be a negative thing for the United Kingdom and the GBP/USD pair.

The pair also rose after Halifax, the company owned by Lloyds Bank, published the latest House Price Index data. The numbers showed that the UK house prices rose at the fastest pace in five years as demand rose. The average house prices, especially in London, has surged because of the policies by the government and Bank of England (BOE).

Meanwhile, the weaker US dollar also contributed to its performance. The dollar slipped against most currencies due to the weak jobs numbers that were published on Friday. The data surprised the market, which was expecting robust hiring to continue and the unemployment rate to decline. Therefore, there is a possibility that the Fed will continue sounding dovish in the near term.

Looking ahead, the GBP/USD will next react to the latest UK GDP and US inflation numbers that will be published tomorrow.

GBP/USD Analysis

The two-hour chart shows that the GBP/USD pair has been in a strong upward trend in the past few days. On Friday, it managed to move above the important resistance at 1.4000, which was the highest level since April 20. It has moved above the 25-day and 15-day moving averages (MA). Notably, the pair seems to be forming a bullish flag pattern, which is typically a sign of continuation. This flag is happening at the second resistance of the standard pivot points. Therefore, there is a possibility that the pair will bounce back as bulls target the third resistance at 1.4266.