Bearish View

- Sell the GBP/USD pair and set a take-profit at 1.3797 (Friday’s low).

- Add a stop-loss at 1.3950.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.3933 and a take-profit at 1.4000 (last week’s high).

- Add a stop-loss at 1.3850.

The GBP/USD price bounced back on Monday after it declined by more than 1.2% on Friday. It rose to 1.3932 on Monday, which was 0.95% above the lowest level on Friday.

UK Recovery Gains Steam

The GBP/USD pair rallied by more than 1.25% year-to-date as the market cheers the progress on Brexit and the government’s momentum on coronavirus vaccinations. The country has already vaccinated more than 34 million people, representing more than 50% of the total population. This ranks it as the second country in terms of vaccinations after Israel.

The results of this vaccination drive have been seen in the country’s economic data. Its unemployment rate has declined below 5% while the manufacturing and services sectors are doing well. Today, Markit will publish the country’s Manufacturing PMI data. Economists expect the data to show that the PMI rose to 60.7.

Still, there is a possibility that the data will miss analysts’ forecasts like that of Germany, France and the United States. A reading of 50 and above 50 will be a sign that the sector expanded in April.

The Bank of England (BOE) will also publish the latest mortgage data. Economists polled by Reuters expect to see that more people applied for mortgages in April to take advantage of a government’s tax incentives. Precisely, they see the number of applicants to have risen from 87.7k to more than 92.3k in March. A higher reading will be positive for the GBP/USD pair.

Still, the biggest catalyst for the GBP/USD pair will be the Bank of England (BOE) interest rate decision that will come out on Thursday. Like most central banks, the BOE will likely leave rates unchanged in this meeting. It will also provide more guidance on the future of quantitative easing. The pair will also react to the latest US non-farm payroll data.

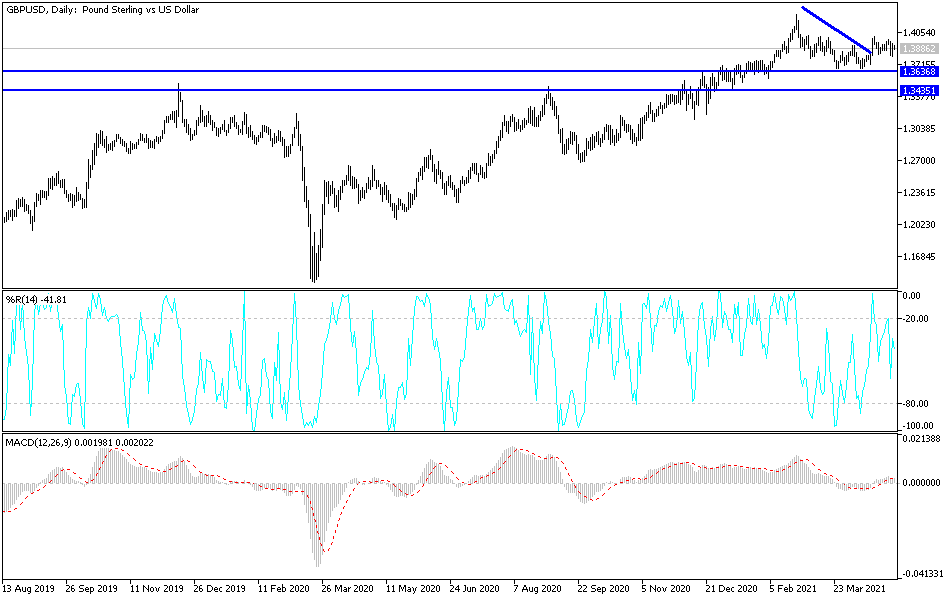

GBP/USD Technical Forecast

The GBP/USD has been relatively volatile lately. On the four-hour chart, the pair has been stuck at the 25-day and 15-day exponential moving averages (EMA). It has also declined from the first resistance of the standard pivots. Notably, it seems to be forming a symmetrical triangle pattern. It has also formed an inverted hammer pattern, which is usually a sign of a reversal. Therefore, the pair will likely retreat in the next two days as investors wait for the BOE decision. The key levels to watch will be 1.3840 and 1.3960.