All GBP pairs are awaiting the Bank of England's announcement today, which explains the narrow performance of the GBP/USD since the start of trading this week.The pair has been trading in a range between the 1.3797 support level and the 1.3926 resistance level, and settled around 1.3896 as of this writing.

Today, the British pound will take direction from the Bank of England, which will announce its decision on strengthening or reducing quantitative easing. The decision taken will send a signal to participants in the Forex market as the BoE moves along the “hawk”/“dove” spectrum, and thus could set the tone for the British pound in the coming days and weeks.

The Bank of England aims to obtain £875 billion in government bonds from the market as part of a program to provide funds to the economy. At the current weekly operating rate of around £4.4bn per week, the target will be met before the end of the year, leading to a sudden loss of economic support from the Bank of England at this time.

So the BoE faces a number of options today. The bank can: 1) reduce weekly purchases now until the end of the year, 2) taper in June (which means a steeper decline in the second half of the year), or 3) increase the size of the program.

Forex analysts consider that the first two options mentioned above support the performance of the pound sterling against the rest of the other major currencies, but the latter may lead to some weakness. Economists at Credit Suisse expect the Bank of England to announce a modest cut in asset purchases from £4.4bn to around £3.0bn a week. Credit Suisse analyst Shehab Galen says it is important for the pound.

What matters for the British pound going forward is the extent of the “hardening” or “pessimistic” tone with which the Bank of England announces its decisions. The basic rule in Forex trading is that a central bank sliding from "doves" to "hawks" is what gives support to its currency as global investor capital tends to chase higher interest rates.

The dove-to-hawk trip culminates in a rate hike, but Credit Suisse still has few expectations of actually raising interest rates until 2023, for the following reasons:

A) UK employment numbers are uncertain after the job leave scheme expires in September, and b) because the Bank of England is actively considering reducing its balance sheet somewhat before raising interest rates, in contrast to previous policy. As such, it is unlikely that the BoE or the market will press hard at the moment against the 50 basis points of rallies already being priced over the next three years, which sends a somewhat constructive cyclical message to the pound in the long term.

How markets interpret the BoE event will also continue to some extent with its changes in economic outlook in its quarterly monetary policy report. Economists at Credit Suisse expect the Bank of England to leave constructive medium-term growth targets unchanged, already from a relatively optimistic stance, but to advance near-term targets and raise growth forecasts for 2021 to 6.5% from 5.1% previously.

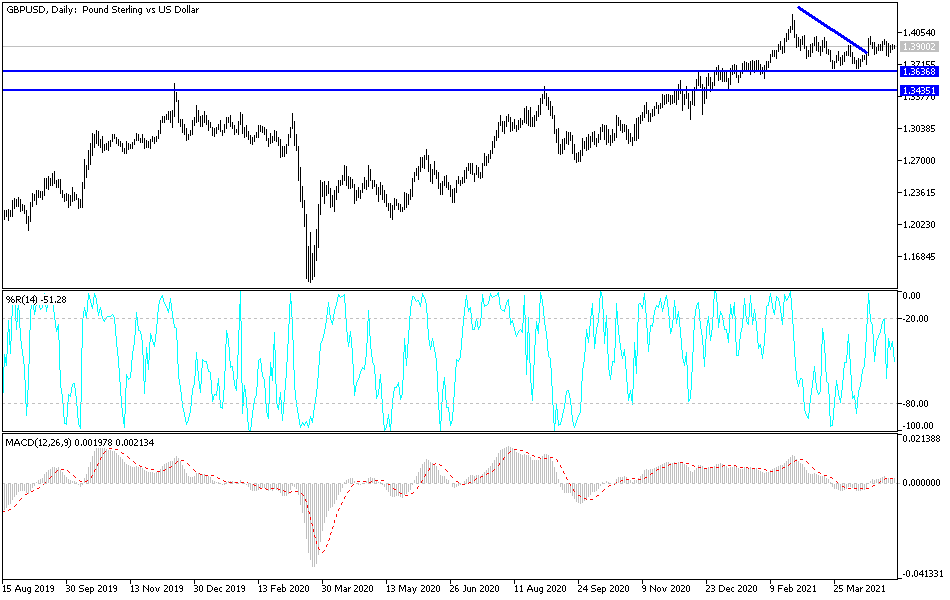

Technical analysis of the pair:

On the daily chart, the bulls are in a prime position to push the GBP/USD through the 1.4000 psychological resistance level, which may increase buying and move towards higher levels, the closest of which are 1.4055 and 1.4165 and 1.4340. On the downside, the negative reaction from the Bank of England to the performance of the pound will push the bears to move towards the 1.3665 support level, which is the most prominent target for the same period of time.

In addition to the announcement of the Bank of England's monetary policy decisions, the currency pair will be affected by the announcement of the number of US weekly jobless claims.