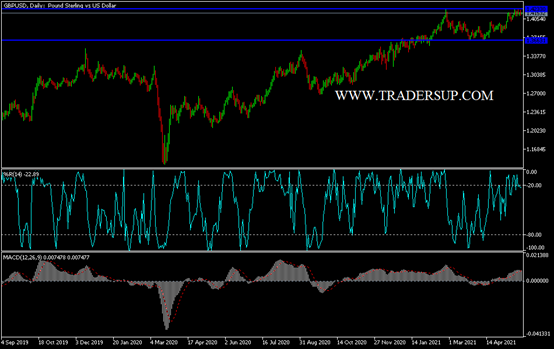

In the recent period that every time the GBP / USD currency pair tries to stabilize above the 1.4200 resistance, it is subjected to profit-taking selling. Its gains since the start of trading this week reached the resistance level 1.4233, the lowest level was the support at 1.4111, and stabilized around 1.4165 at the time of writing the analysis. So far, the British pound risks giving up the gains it made against the euro and the dollar during the month of May if the current bout of weakness extends to the end of the month. The pound has already retreated three-quarters of the percentage against the euro this week, while Tuesday's session saw small gains this week against the dollar.

It is disappointing for those looking to deal with the British pound, as there is no clear news or data to prove the recent declines, so identifying any potential triggers that might turn the tide in the pound's performance is a difficult task. The most helpful explanation for this recent tepid performance is that the news and data lights have shifted away from the UK this week and focus is shifting to other currencies as there are conditions for higher prices, most notably the Euro. Commenting on this, Dara Maher, Head of Research at HSBC, says: “The British pound’s failure to keep pace with the euro aligns with our view that much of the good news about the UK economy is already being translated into the pound sterling”.

For their part, Deutsche Bank Forex analysts said last week: “After we bet on the sterling's rise at the start of the year, we are now heading to the downside.” Accordingly, Deutsche Bank - one of the largest foreign exchange forex dealers in the world - said in a new strategic brief that "while the stars are lining up so far this year for the pound sterling, there is a lot of good news in the price." Currently, the exchange rate of the pound against the dollar (GBP / USD) looks more positive, and as recently as Tuesday, it has returned above 1.42.

However, much of this movement was the result of continued weakness in the US dollar, which supports the view that the British pound lacks distinct bullish engines.

Also, analysts at JP Morgan say the market is "in good shape" in response to the good news of the GBP regarding vaccinations and the reopening of the economy for some time now. "This would leave the pound sterling vulnerable to the reopening of other major economies and the consequent rebalancing of interest rate differentials," says Mira Chandan, Forex analyst at JP Morgan. This view is particularly appropriate against the euro, which appears to be the current darling of the currency market, as investors grabbed euro-zone assets in anticipation of the region's recovery.

British economic data generally exceeded expectations (the UK's economic surprise index is currently +47 versus 23 in the eurozone and zero in the US), but this did not necessarily translate into any additional clear upward pressure on the ranked expectations in recent weeks in the UK. It is these expectations of higher interest rates that matter. When UK interest rates rise, the British pound tends to get a boost.

For UK interest rate expectations to rise, the market must become increasingly convinced that the Bank of England (BoE) is looking to advance the timing of the first rate hike in the next cycle.

According to the technical analysis of the pair: So far, despite the weakness of the upward stimulus, the general trend of the GBP / USD currency pair is still up, and there will be no first reversal of the trend without moving towards the support level 1.3980. Profit-taking selling for the currency pair is best placed around 1.4245 and 1.4320 resistance levels, respectively. The currency pair will remain in a narrow range until the results of the US inflation data are released.