This was before stabilizing around 1.4105 at the time of writing the analysis and before the announcement of a package of important US economic data. This week, the Sterling is suffering from a lack of data and exciting events from Britain. The pace of vaccinations and the scheduled abandonment of the restrictions of the Corona epidemic continues to give the Sterling the momentum needed to show resilience.

Alongside this, expectations of higher interest rates matter. When UK interest rates rise, the pound tends to get support. For UK interest rate expectations to rise, the market must become increasingly convinced that the Bank of England (BoE) is looking to advance the timing of the first rate hike in the next cycle. All the BoE policymakers who have spoken about this recently have been firm in the view that there is no rush to push interest rates higher.

While inflation may rise in the UK, Bank of England Governor Andrew Bailey and some of his colleagues to the Treasury Select Committee said on Monday that inflationary pressures were likely to be temporary. Andy Haldane, Chief Economist at the Bank of England, gave an unsurprisingly optimistic testimony to the committee, but Bailey, John Cunliffe and Michael Saunders felt that the rise in inflation would be temporary in nature.

Therefore, this is likely to be given that Haldane is due to leave his position as Chief Economist at the Bank of England.

The Bank of England confirmed on May 6 that it is on track to end its current program of quantitative easing by the end of the year, in line with expectations that the economy will recover from the Covid-19 crisis. At the meeting, they said they would "reduce" the amount of bonds they would buy on a weekly basis to 3.4 billion pounds from 4.44 billion pounds to ensure that the current quantitative easing program of 150 billion pounds extends through the end of the year.

Exit from the Bank of England market will come amid the continued issuance of new debt by the government to pay for the repercussions of the Covid-19 crisis.

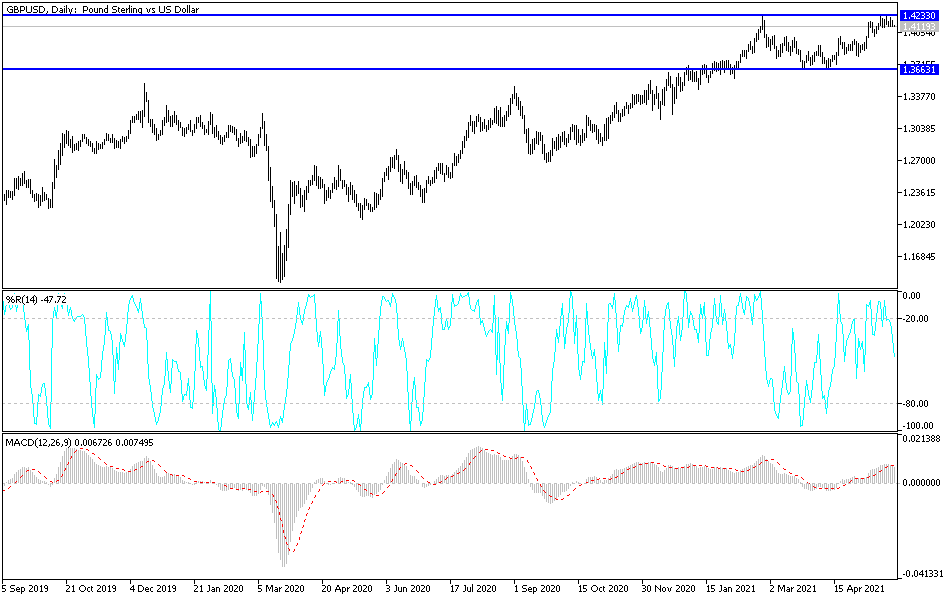

Technical analysis of the pair: The future of the upward trend of the currency pair of the British pound against the US dollar (GBP / USD) may shake in the event that it moves around and below the 1.4000 support level, which is the closest to it now. Trading began on Thursday amid selling pressures that may strengthen these pressures in the event that the US data results are better. From expectations. I am still best selling the currency pair from every upside level and the closest resistance levels are currently for the pair 1.4185, 1.4255 and 1.4320, respectively.

As for today's economic calendar data, there are no important UK economic data. From the United States of America, the most important news will be the GDP growth rate, weekly jobless claims, durable goods orders and pending US home sales.