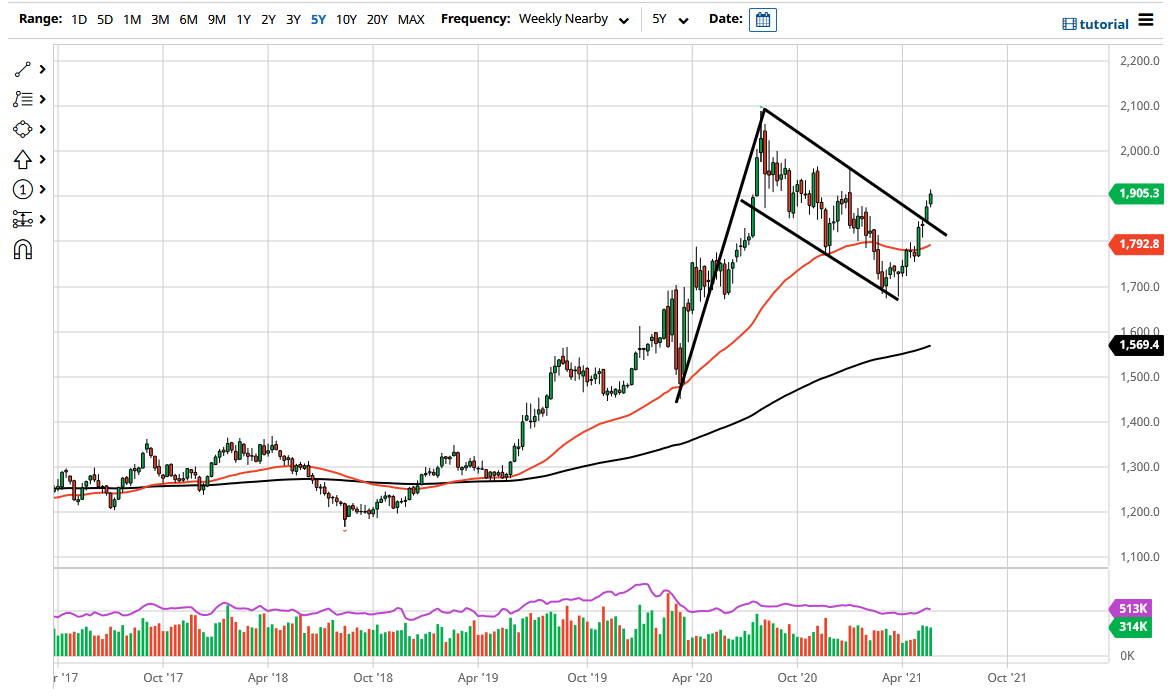

Gold markets rallied quite drastically during the month of May and have pierced the $1900 level. At this point, it is very possible that the market is due for a short-term pullback, but as you can see, I have drawn a major flag on the weekly chart, so somewhere near the $1850 level I would anticipate a lot of buyers coming back into this market. After all, there are a lot of concerns about inflation in the United States and the devaluation of the greenback, with gold being a major way to combat that.

If we can pull back towards that $1850 level, I would anticipate that there would be a lot of people willing to get involved based upon the downtrend line. The 50-week EMA is sitting right around the $1800 level and tilting higher. For what it is worth, the bullish flag measures for a move to roughly $2400, but obviously that is not something that would happen overnight. Because of this, I think that although June should inevitably be good for gold, I do not necessarily think that we will shoot straight up in the air; but I do think that we are building a substantial breakout. It comes down to your leverage size, but if you are buying physical gold, then buying up at this price is probably going to be okay. But if you are trading something levered like a CFD or futures contract, then you need to see some type of pullback in order to buy gold “on the cheap.”

If we were to turn around and break down below the $1800 level, that would negate all of this and send gold much lower. I would anticipate at that point that the bond yields would either spike drastically in the United States to make more of a “real return”, or the US dollar strengthen overall. If we were to see that happen, then I think the $1700 level would be an area that would be crucial, because if we were to break down below there, we would wipe out a major double bottom on the daily chart. I do not see that happening, and as we go into the summer, I look at pullbacks as a potential buying opportunity as inflation should continue to pick up at least until the end of the year.