Gold markets rallied a bit during the trading session on Friday to reach towards the $1850 level before pulling back a bit in reaction to the jobs figure that was so poor. The US economy added 266,000 jobs during the month of April, much less than the anticipated 1 million. This is because people are being paid to sit at home, so it should not be a huge surprise that the jobs number was so poor. Nonetheless, this has a negative effect on the US dollar and the yields coming out of that country. Ultimately, this is a market that has broken out recently, and it looks as if we are going to continue to go higher.

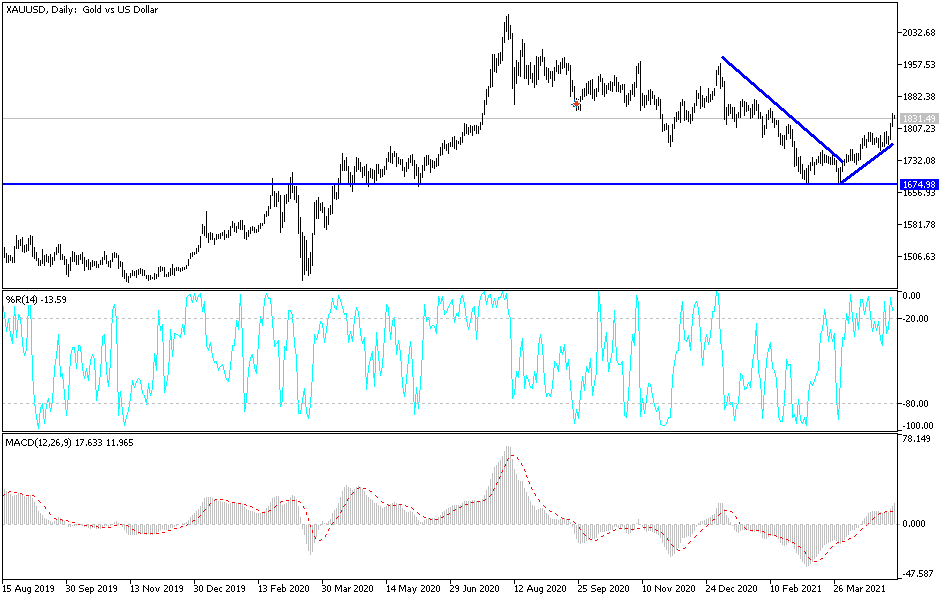

If we manage to break above the $1850 level, then it is likely that we see gold go looking towards the $1950 level. The double bottom recently formed at the $1700 level is the “floor in the market” from what I see, and as a result, I think what we are looking at is an opportunity to buy on dips when they occur, although I do have a downtrend line drawn on the chart that could offer a bit of downward pressure. That being said, the market breaking above the $1850 level clears that.

Pay close attention to US bond yields, because the falling of yields makes the US dollar less attractive, as there is no need to buy bonds for such a paltry and negative real rate of return. That makes gold much more interesting, and I think what we have here is a scenario where the shot higher that we have seen recently still has legs. That being said, we did give back some of the gains at the end of the session, but part of that may have simply been the fact that we were close to a major resistance barrier at the end of the week, and a lot of people would have wanted to go home this weekend “flat.” At this point, the 200-day EMA underneath is what I look at as a major support level, currently sitting just below the $1800 level. With this being the case, it is likely that we will continue to see more of a push to the upside, but there is going to be a little bit of resistance. Expect choppy yet bullish momentum.