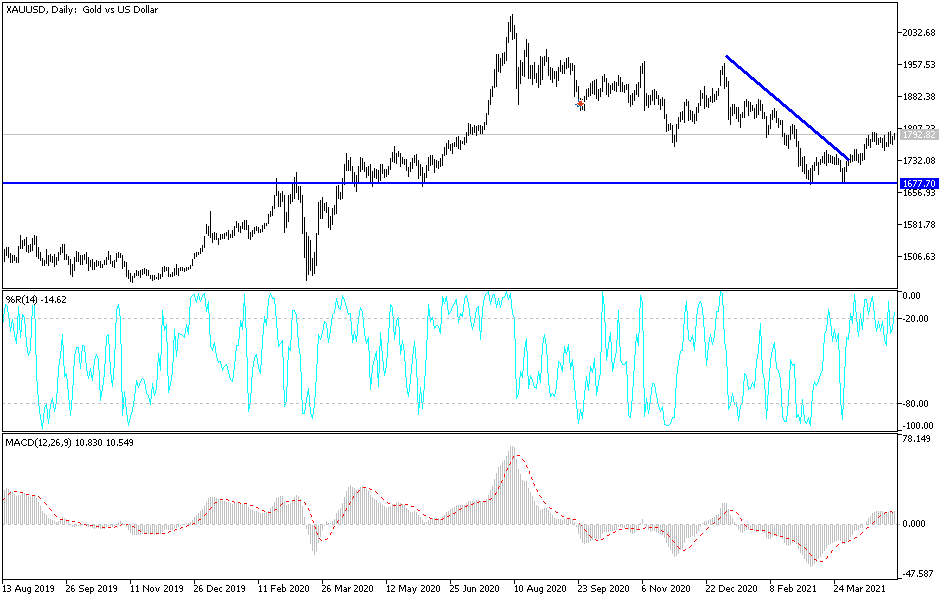

The gold markets initially pulled back during the trading session on Wednesday to test the 50-day EMA, only to turn around and start rallying again as we have seen multiple times over the last couple of weeks. Gold has nowhere to be right now, so unless you are a short-term scalper, this is probably going to be a miserable market for you.

On the other hand, if we can break above the $1800 level, then it gives us a clear shot towards the $1850 level, where we had seen a significant amount of resistance. Furthermore, if we can clear that area, then it is likely that we will go looking towards the $1950 level. That is an area that was extreme selling pressure. Conversely, if we were to break down below the $1750 level, then it is very likely that we would go looking towards the double bottom underneath which is just below the $1700 level.

If and when we can break down below the double bottom, that would open up the trapdoor to much lower pricing, perhaps sending this market as low as the $1500 level. The $1500 level is obviously a large, round, psychologically significant figure, and an area that we can look back through multiple times as an area of interest. That being said, I think in the meantime, gold markets are probably waiting for some type of catalyst, which may be the jobs number coming out on Friday.

Pay attention to yields, because they have been a major driver of where gold markets go, as rising yields offer a “real rate of return” that can influence whether or not people are willing to pay for storage in this market. It is easier to clip coupons in the bond market than it is to deal with massive amounts of gold. Retail traders do not think about this, but I can assure you that larger traders do, as those are the ones who move the market and pay the bills, so to speak. In the short term, it looks like we are simply going to go sideways, and we just do not have any catalyst. I suspect that Thursday will probably be even worse, as we await the jobs figure and have nowhere to be.