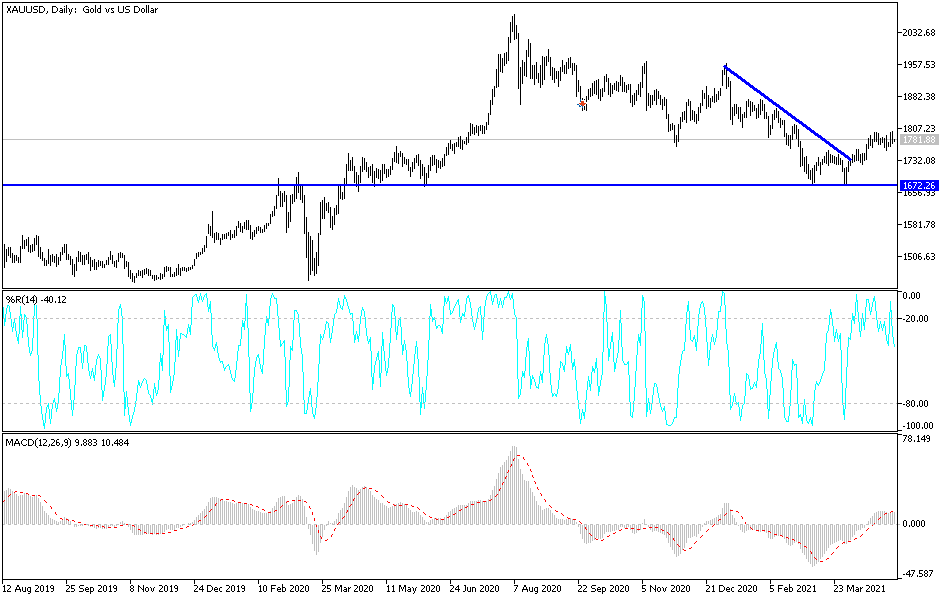

The gold markets initially tried to rally during the trading session on Tuesday but could not break above the $1800 level. The $1800 level is an area that will attract a certain amount of attention, so it is likely that we will see a continued pushback every time we get a bit too close to it. If we can break above the $1800 level, then I do think that we will enter a bullish run, perhaps looking towards the $1850 level, followed by the $1950 level.

Ultimately, taking that move will have a lot to do with the US dollar and yields in the bond market. Pay close attention to the US dollar, because if it continues to slide it could give a bit of momentum to the upside for gold, as it tends to move in a huge negative correlation. The gold markets are trying to figure out where to go next, as we are stuck between the 50-day EMA and the 200-day EMA. At this point, the market is likely to see a lot of noisy behavior, so it is definitely going to continue to see a lot of choppy behavior.

If we were to break down below the $1750 level, then it is likely that we would see a significant drop, perhaps reaching down towards the double bottom that sits just below the $1700 level. That is an area where I think there should be a significant amount of support, but if we do break down below there, it is likely that the market would then go looking towards the $1500 level. It would obviously take a significant amount of negative pressure to get down below there, but I think in the short term it is very unlikely that the market moves down to that level.

I believe that the market is probably going to continue to see a lot of volatility, so short-term trading in a back-and-forth manner probably makes the most sense in the short term. However, we should eventually get a significant and impulsive candlestick, and possibly sure trading in one direction or the other. In the meantime, all we can do is simply wait to see whether or not we are going to be able to get a clear signal.