Gold markets fell hard during the session on Wednesday as inflation numbers in the US saw quite a bit of destruction in some of the risk appetite the traders have been willing to take on. This inflationary surprise has had the greenback again against certain currencies, with perhaps the exception of the Canadian dollar and the British pound. The Australian dollar on the other hand has been hammered, right along with other interest-rate sensitive commodities such as gold.

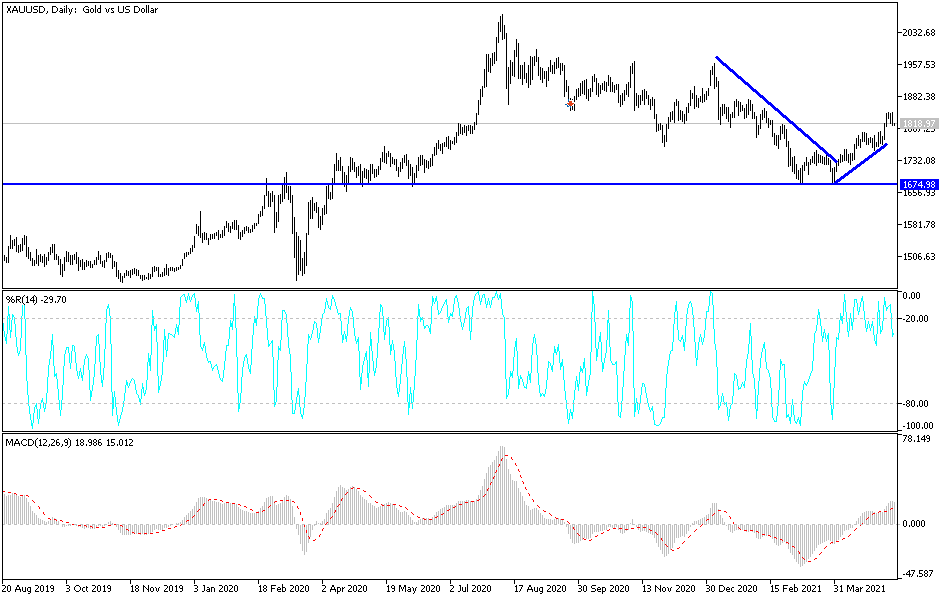

When you look at this chart, you can see that we are clearly trying to break the back of the hammer from the previous session. If we do, then that technically makes the candlestick a “hanging man”, which is a very negative sign. At that point we are more than likely going to go looking towards the 200-day EMA which is at the $1793 level. With rising inflation, that means rising interest rates given enough time. Rising interest rates work against the value of gold, as the average investor will be happy to clip coupons in the bond market as opposed to paying for storage of gold.

Ultimately, I think that we need to make a serious decision rather quickly, but it will be interesting to see how the gold market plays out due to the bond markets and their behavior. From a technical analysis standpoint, there are a handful of areas that I am paying close attention to. The $1850 level is an area that I would be very interested in if we can break above that level on a daily close. By doing so, the market is likely to go looking towards the $1950 level. On the other hand, if we were to break down below the 200-day EMA as well as the 50-day EMA, the market could go down towards the double bottom that recently had formed.

Breaking down below that double bottom opens up a massive selling movement that could send this market all the way down to the $1500 level. This would be helped greatly by interest rates rallying significantly, and perhaps more importantly, the rate of change when it comes to those interest rates. If we get a sudden spike higher in the yield bonds, that will be devastating for gold.