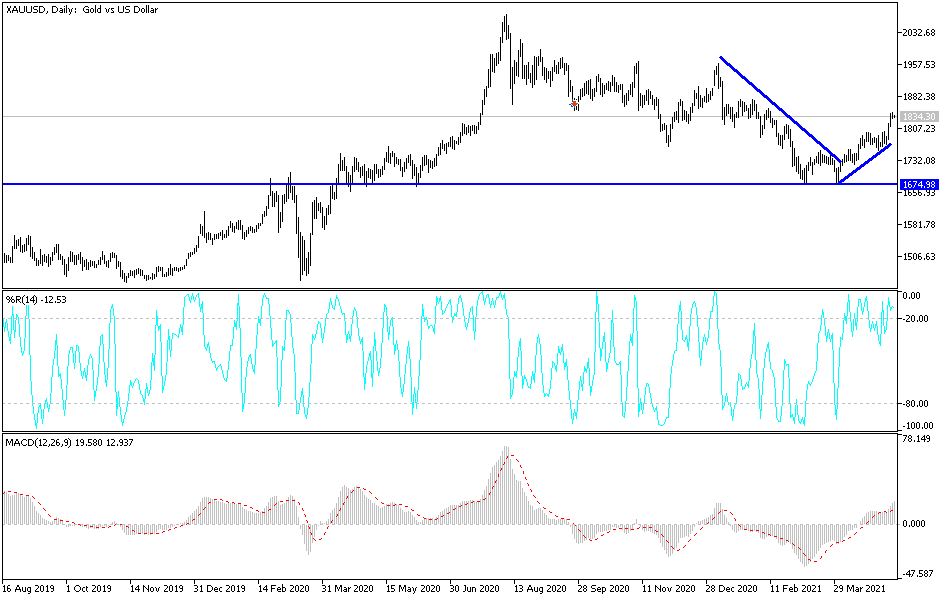

Gold markets did very little during the trading session on Monday as they are testing a downtrend line that started at the very top of the market several months ago. Because of this, it looks as if the market needs to convince itself whether or not it can continue the overall upward momentum. It should be noted that we recently have had a couple of very strong candlesticks, so a pullback would make a certain amount of sense. This is especially true considering that it was just two trading sessions ago that we cleared the 200-day EMA.

I also recognize that there is a lot of noise between the 200-day EMA and the 50-day EMA underneath, so it does make sense that there is a lot of support in that area that could keep the market somewhat elevated. However, we could also just simply break above the downtrend line and clear the $1850 level. It would be a daily close above that level that would have me become more bullish, but at this point in time I think it makes sense that we could pull back. Regardless, I think what we are going to see is a lot of choppy behavior, so we will have to build up a bit of inertia to finally break out even further.

You should also keep an eye on bond yields in America, because if those yields start to rise, that could also work against gold, which is still technically in a downtrend, despite the fact that we have seen such a strong move to the upside. However, if we were to break above the $1850 level on a daily close, then I believe that gold has a good shot at going to the $1950 level, which is an area where we had seen a lot of selling pressure. The breaking of the $1850 level could kick up more momentum, making the move to the $1950 level happen much quicker than most people would realize. If we break down, and if we get below the 50-day EMA, it could open up a move down to the $1700 level where we had seen the double bottom form that suggested we were ready to turn around.