The bulls succeeded in pushing the gold price to the resistance level of $1843 by the end of last week's trading, a 3-month high, and settled at the beginning of this week's trading around $1830. Gold's recent gains were supported by a disappointing US jobs report and a weakening US dollar. Accordingly, the price of the yellow metal rose by more than 3% to over $1800. Therefore, gold recorded a weekly gain of about 3.6%, to reduce its annual loss to less than 4%.

As for silver, the sister commodity to gold, it paused its recent gains as silver futures slumped to $27,415 an ounce. Accordingly, the white metal recorded a weekly rise of about 5.6%, which raises its rise in 2021 to about 3.4%.

In general, gold prices benefitted from the lower-than-expected US jobs report for April, which saw the US economy succeeding in creating 266,000 new jobs. Many economists predicted as many as 1 million new jobs last month. The unemployment rate in the country rose to 6.1%. This made investors bet that the US Federal Reserve would maintain its accommodative monetary policy, while keeping near-zero interest rates and quantitative easing efforts intact. Therefore, Neil Kashkari, Chairman of the Federal Reserve Bank of Minneapolis, assured that quantitative easing will remain in place because the US economy still has a long way to go.

Although some question the strength and speed of the post-coronavirus economic recovery, the consensus is that the labor market has highlighted a growing problem: a shortage of labor supply.

Meanwhile, the US dollar weakened after the employment report. The US Dollar Index (DXY), which measures the performance of the greenback against a basket of six major rival currencies, fell to 90.35. A lower dollar is beneficial to dollar-denominated goods because it makes them cheaper for foreign investors to purchase. On the other hand, that affects the price of gold. The US Treasury bonds were mostly in the red by the end of last week's trading, with the yield on the 10-year bonds declining to 1.551%. One-year bonds fell 0.002% to 0.051%, while 30-year notes rose 0.018% to 2.254%. Lower bond yields are good for bullion and do not give a return because they reduce the opportunity cost of holding the metals.

In terms of other metals markets, copper futures rose, reaching $4,740 a pound. Platinum futures fell to $1254.00 an ounce. Palladium futures fell to $2,927.00 an ounce.

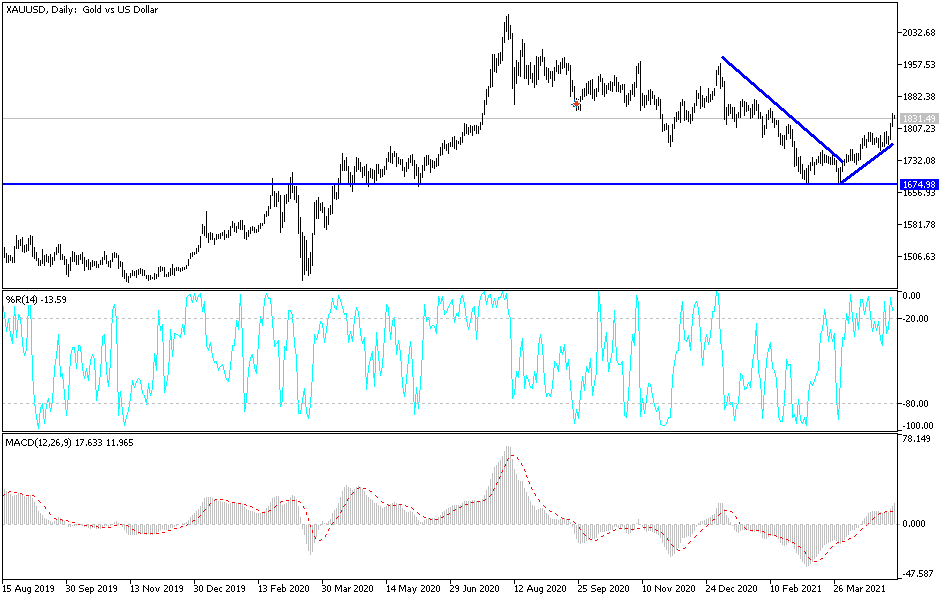

Technical analysis of gold:

So far, the general trend of gold has turned bullish, as long as it is stable above the psychological resistance of $1800. According to the performance on the daily chart, the technical indicators will reach overbought levels in the event of a move towards resistance levels of $1848, $1865 or $1885. At the same time, the new trend will be reversed if the bears return to breach the support level of $1785. I still prefer to buy gold from every downside.

Amidst the absence of important economic data today, investor risk sentiment will have a strong direct impact on the price of gold.