The sharp decline of the US dollar was a strong impetus for the price of gold to move to the level of $1845, its highest in three months. With four bullish trading sessions, the price of gold settled today around the level of $1836 an ounce at the beginning of trading on Tuesday. The dollar continued its decline on speculation that the US Federal Reserve will keep interest rates near zero in the future. Besides, weakness in the US stock markets also contributed to an increase in demand for gold as a safe haven. US jobs numbers pushed the US Dollar Index (DXY) to its lowest level in nearly two-and-a-half years.

Silver futures ended trading at $27.49 an ounce, while copper futures for July settled at $4.7160 a pound.

Data released by the US Labor Department at the end of the week showed a much smaller-than-expected increase in non-farm payrolls in the US in April, raising the odds of a longer-term low interest rate regime. The data showed that the US economy added 266,000 jobs in April after it increased by 770,000 jobs, revised downward, in March. Economists had expected an increase in employment of 978 thousand jobs compared to the jump of 916 thousand jobs originally reported for the previous month.

Survey results from Sentix showed that investor confidence in the Eurozone improved to the highest level in more than three years in May, indicating that the recession caused by the coronavirus has been overcome. According to the results, the Investor Confidence Index rose significantly to a reading of 21.0 in May from a reading of 13.1 in April. The result was the highest since March 2018. The reading was expected to rise moderately to 14.0. The current assessment and expectations were strengthened in May. The Current Situation Index came in at 6.3, the highest level since May 2019, compared to -6.5 in the previous month.

Meanwhile, the Outlook Index hit an all-time high of 36.8 in May, up from 34.8 a month ago.

According to the Syntex research center, this is very unusual and confirms that the highly expansionary monetary and fiscal policy in place for a year has not failed to affect the real economy. However, there are growing signs that the Eurozone economy is being overly stimulated.

Home prices in Britain hit a record high in April as postponement of stamp duty continued to provide momentum to the real estate market, data from Halifax, Lloyds Bank subsidiary and IHS Markit showed. According to the results, UK home prices increased 1.4% in the month in April, after rising by 1.1% in March. The average property value is £258,204. On an annual basis, home price growth accelerated to 8.2% from 6.5% last month. That was the highest annual rate in five years.

In the three months to April, house prices were 0.9% higher than in the previous three months.

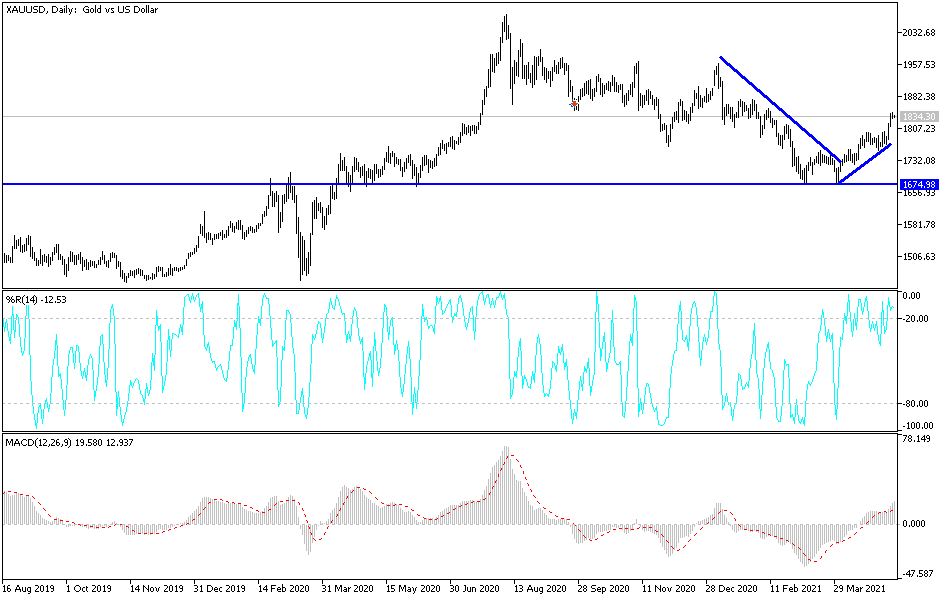

Technical analysis of gold:

Stability above the psychological resistance of $1800 will support the bullish trend and increase the chances of buying to push the price of gold to stronger ascending levels. This will depend on the continued decline of the US dollar. Currently, the closest resistance levels for gold are $1845, $1862 and $1879. It must be taken into account that these levels will push the technical indicators into strong overbought areas, at which point profit-taking will be triggered. There will be no reversal of the current trend without breaching the support level of $1792.

The price of gold will be affected today by the strength of the US dollar and investor risk appetite.