Gold’s weak attempts to rebound higher during last week's trading did not exceed the $1790 resistance level, and last Thursday's session was disastrous. In general, the rise in Treasury yields and the rise in the US dollar affected the trajectory of the precious metal. Many metrics indicate a possible recovery in the price of gold later in the second quarter, but investors may take a wait-and-see approach to global financial markets with the start of trading in May.

The price of gold recorded a weekly loss of about 0.5%, yet it recorded gains in April of more than 2%. Since the beginning of the year 2021 to date, the price of gold has decreased by 7%. Silver, the sister commodity to gold, is one of the few commodity assets that finds a definite direction to close out weekly and monthly trades. Silver futures rose to $26.145 an ounce. The price of silver registered a weekly jump of 0.4% and a monthly increase of 4.4%, but it's still down 1.4% this year 2021 so far.

One of the factors affecting the metal market strongly is US bonds. The US bond market is mostly heading into the green, with the record 10-year Treasury yield rising to 1.645%. The yield on the one-year notes rose to 0.053%, while the yield on the 30-year notes rose to 2,316%. Higher bonds are usually bearish for unprofitable gold because they can increase the opportunity cost. The price of the US dollar is also a strong influence on the price of gold. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to the level of 91.23, and as it is known, a strong dollar is bad for commodities priced in dollars because it makes it more expensive for foreign investors to buy.

Although ETFs have rallied over the past month, Commerzbank reported that gold ETFs monitored by Bloomberg saw about 30 tons of outflows last week.

Relative to the prices of other metal commodities, copper futures rose to $4,055 a pound. Platinum futures rose to $1214.40 an ounce and palladium futures rose to $2,979.50.

US Treasury Secretary Janet Yellen said yesterday that the massive spending proposed by President Joe Biden on infrastructure, families and education will not fuel inflation because the plans will be gradual over 10 years. New economic reports portrayed a rapid recovery from the recession caused by the pandemic. Americans' incomes rose by the most on record in March, buoyed by federal stimulus payments of $1,400, and the economy grew at a strong annual rate of 6.4% in the first three months of the year, leading to concerns about inflationary pressures.

Some economists, notably former Treasury Secretary Larry Summers, have warned that the Fed's current ultra-low interest rates, combined with the $4 trillion the Biden administration proposed in new spending, above the $5 trillion already approved by Congress, are risking accelerating inflation.

Biden presented his expansion plans in a speech he gave to Congress last week. He will expand the social safety net for children, raise taxes on the wealthy, and fund projects that take an ambitious definition of infrastructure, with a focus on long-term economic stability with middle-class jobs.

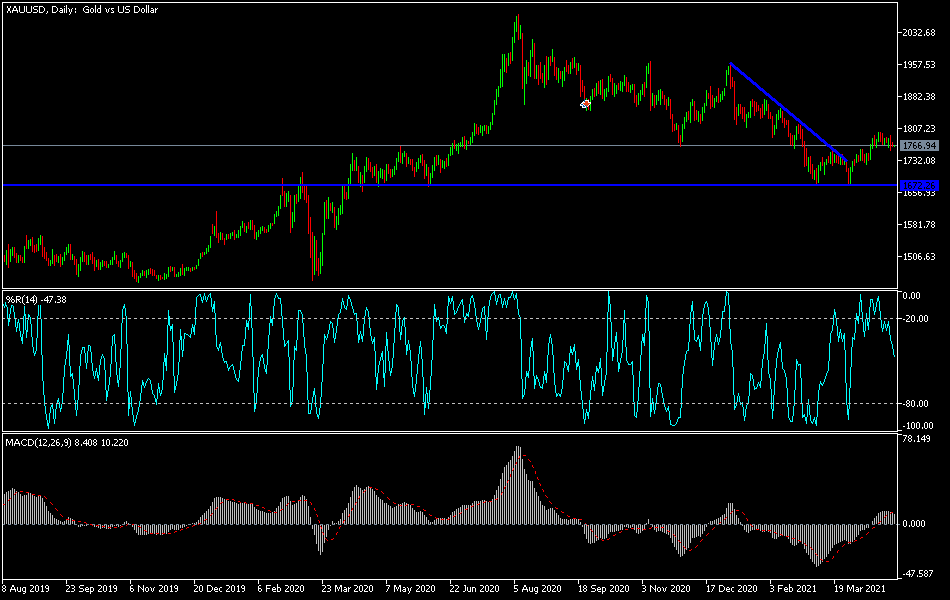

Technical analysis of gold:

On the daily chart, despite the failure of gold’s rebound attempts, the opportunity remains. The optimistic outlook will end if the price of gold collapses to the support level of $1720. On the upside, a return to test the resistance level of $1785 is important to enable the bulls to penetrate the psychological resistance level of $1800. All in all, I would still prefer to buy gold at every downside.

The price of gold will be affected today by the market risk appetite, along with the strength of the US dollar and the reaction to the announcement of the PMI reading for both the Eurozone and the United States of America.