The continued weakness of the US dollar has caused strong and sharp gains for the price of gold, which recently resulted in a break through the psychological resistance level of $1900. The rebound gains reached the $1913 resistance level, its highest in more than four months. The profit-taking at the end of last week’s trading pulled the gold price to the support level of $1883, and investors took advantage of that to think about buying gold again. The price then rose to the level of $1904 at the beginning of this week’s trading.

The gold market had an impressive month in May, buoyed by inflation concerns and a weak US dollar. The question now is whether the gold price will reach the historic high of $2000 an ounce. We think that may depend on where the economy stands heading into the summer and whether consumer and producer prices will rise over the coming months.

The price of gold posted a weekly gain of 1.2%, bringing its monthly rise to nearly 8%. Since the beginning of the year, the price of gold has increased by 0.14%. All in all, gold is on its way to achieving its best monthly performance since July of last year. The price of silver stabilized above the level of $28 an ounce. Therefore, the white metal recorded a weekly jump of 1.3%, and monthly gains of approximately 8%, and has achieved gains of 6% since the beginning of the year.

Investors and gold traders were watching the numbers confirming that inflation rose more than expected. They are also waiting for the Fed's position on its quantitative easing efforts and whether the US central bank will start reducing its $120 billion in corporate and government bond purchases per month and then start raising US interest rates.

Currently, the metals market in general is benefiting from a weak dollar. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to 90.01, and during last week's trading it fell by 1.4% for the month. A depreciating US currency is generally considered bullish for dollar-denominated commodities because it makes them cheaper to buy for foreign investors. On another influential level, we also noticed a divergence in the performance of the US bond market, as the 10-year Treasury yield decreased by 0.01% to 1.594%. One-year bond yields rose 0.003% to 0.043%, while 30-year yields rose 0.0808% to 2.265%. The trend of bonds can also drive gold markets because it will determine the opportunity cost of owning non-yielding bullion.

Meanwhile, financial analysts see the correction, which was driven by confidence in the economic recovery, in gold as beneficial for investors. In this regard, Peter Groscoff, CEO of Sprott, said, “After a healthy correction due to confidence in the recovery, gold now anticipates investor concerns about public debt and deficit levels. Gold fundamentals have never been better - record levels of debt and deficits, financial markets that have been priced to perfection and the emergence of inflation in response. Gold should now move with a higher strength.”

Relative to other metals markets, copper futures rose to $4.675 a pound. Platinum futures rose to $1,1181.20 an ounce. Palladium futures rose to $2,834.00 an ounce.

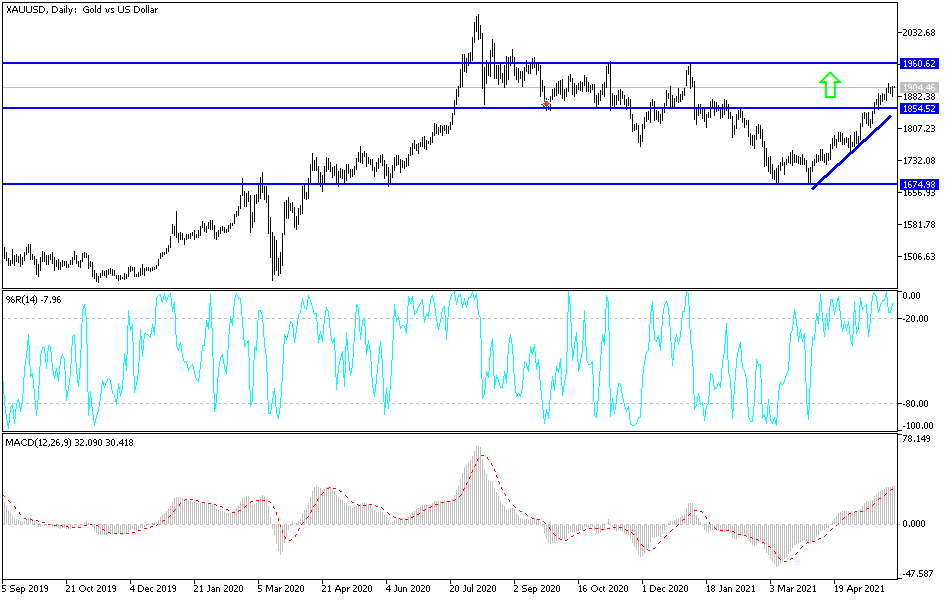

Gold technical analysis:

The stability of the gold price is still above the psychological resistance of $1900, which raises more buying, especially if the decline of the US dollar continues. With the bulls eyeing the historical peak of $2000, there must be a catalyst for this to happen. The weakness of the US dollar, along with lower-than-expected US job numbers this week and growing concerns about global plans to reopen global economic activity amid mutated strains of the COVID-19 pandemic will likely affect gold's movement.

On the daily chart, the recent gains in gold pushed the technical indicators to strong overbought levels, and profit-taking is expected at any time, as happened in the last Friday session. The closest resistance levels for gold are currently $1919, $1928 and $1945. The closest important support levels to the last performance are $1885, $1870 and $1858.