Despite the dollar's recovery from its recent losses, gold prices continued to rise with sharp gains, reaching the resistance level of 1913 dollars per ounce. This is its highest in more than four months, before settling around the level of 1895 dollars per ounce at the time of writing the analysis. The yellow metal got more momentum due to inflation concerns and lower Treasury yields. In the same performance of gold, silver futures closed at 27.877 dollars an ounce, while copper futures settled at 4.5295 dollars a pound.

The US dollar fell to its lowest level in several months in recent sessions, weighed by comments by several Fed officials that any inflation will be temporary and the US central bank will maintain its current pessimistic stance on monetary policy. In contrast, gold's movements over the next two days are likely to depend largely on inflation data, economic growth and unemployment claims.

Commenting on the performance of gold, Lokman Otunoga, chief research analyst at FXTM, said that gold continues to rise and draws its strength from “inflation concerns and weak Treasury yields. Given the extent of persistent concerns about rising inflationary pressures, what is the best way to hedge against inflation than gold? ” Colin Blume, Noble Gold Founder and CEO, said: “The approach of gold to $ 2,000 is not surprising. It is a correction because gold ... has been undervalued for decades now, he said, as the supply of the precious metal in the world is limited and cannot produce more. And it's much more valuable than the price we're paying for it. ” Blum added that it would take "an astronomical event to produce more gold."

Commodity analysts explained that speaking from a number of Fed officials, who have expressed short-term tolerance for rising inflation as the economy recovers from the COVID-19 pandemic, helped boost the bullion price. “Gold continues to look good due to the continued weakness in dollar and bond yields - thanks mainly to the pessimistic Federal Reserve, which remains adamant that emergency stimulus measures continue at full capacity,” wrote Fouad Razakzadeh, a market analyst at ThinkMarkets.

Accordingly, the price of gold is heading towards monthly gains of more than 7%, and its recent rise helped turn into positive territory in 2021, up 0.3%. Current bullion gains put it on track for its best monthly rally since July.

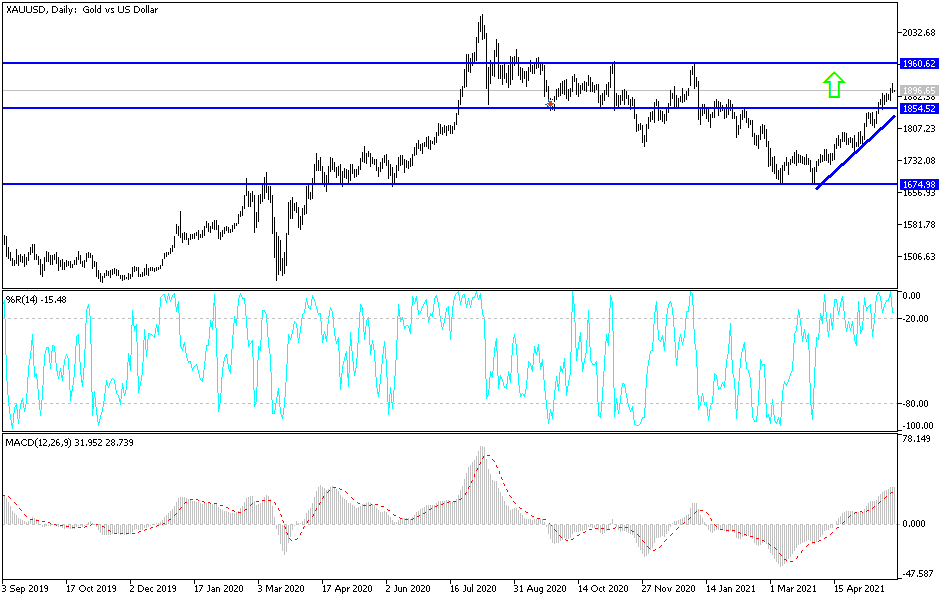

According to the technical analysis of gold: The gold price's breach of the psychological peak of 1900 dollars an ounce strengthens the current general bullish trend. In the event that the results of the important US economic data come today, the rate of GDP growth, weekly jobless claims, durable goods orders and pending US home sales. Better than expectations, the price of gold will be negatively affected, as it moves towards immediate support levels, to 1875, 1855 and 1840, respectively. If the data comes in worse than expected, the US dollar will decline and the opportunity will be stronger for gold bulls to move towards resistance levels 1916, 1928 and 1940 respectively, which paves the way for the next historical psychological summit of $ 2000 an ounce.