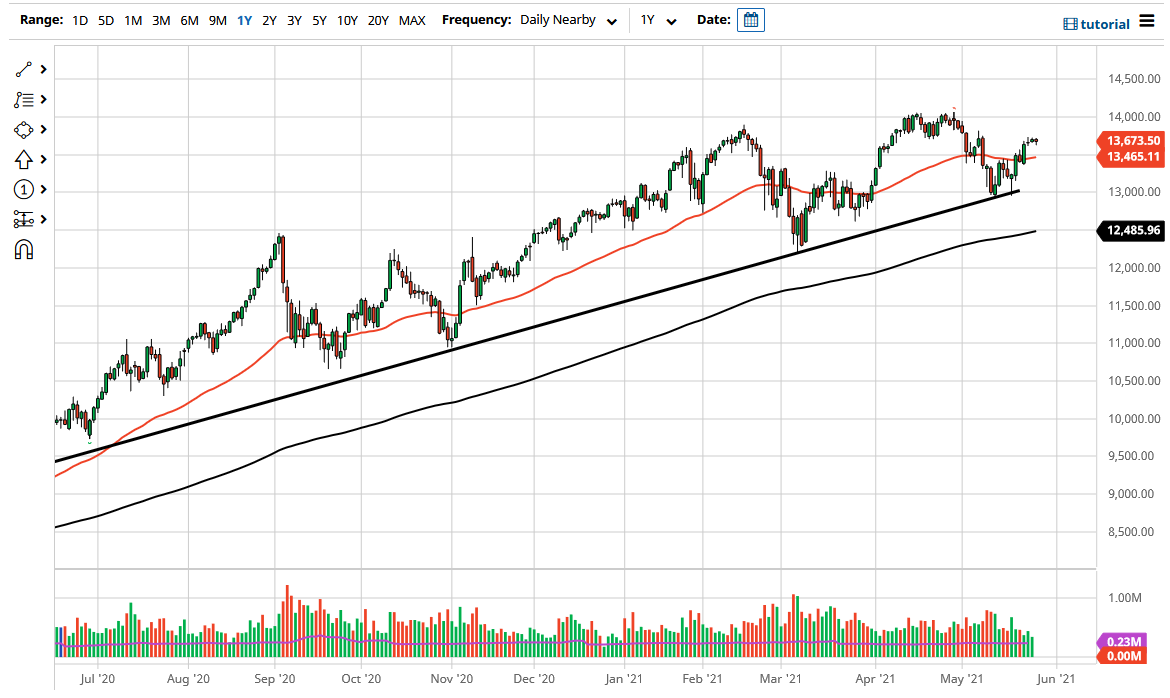

The NASDAQ 100 has pulled back just a bit during the course of the trading session on Thursday as we continue to sit still near the 13,700 level. At this point, the market is likely to see a certain amount of buying pressure underneath, especially near the 13,500 level, where we see the 50 day EMA curling up and above. Ultimately, the market looks as if it is going to go looking towards the 14,000 handle, and that of course is an area that you should be paying close attention to as it was the all-time high.

The 14,000 level above is the top of what could be thought of as an ascending triangle, and therefore a breakout above that level could send this market looking to much higher levels. The ascending triangle is essentially 2000 points, so if we do break out, I would have a target of 16,000 with the idea of the 15,000 level being important enough to cause a little bit of resistance and/or selling pressure. If we can break above that, then obviously the market has much further to go.

I do not expect that to happen this year though, because the move to 16,000 will take a lot of momentum. That being said, I do think that it is only a matter of time before buyers would come back in and pick up little bits of value in this market. The NASDAQ 100 could see another sell off, but I would look at that as an opportunity to get long due to the bullish pressure in general.

Furthermore, the NASDAQ 100 has formed a little bit of a “W pattern”, and therefore it does look healthy in general but that does not necessarily mean that we need to explode to the upside. Ultimately, I think this is a market that will continue to be noisy yet positive in general. If we do break down below the uptrend line, then I might be a buyer of puts, but that is about it as far as bearish momentum is concerned, due to the fact that I have no interest whatsoever in trying to short US indices with the Federal Reserve out there liquefying the markets. With this, I think we are simply looking for an opportunity to find a reason to go long heading into the weekend. Speaking of the weekend, it is worth noting that Memorial Day is Monday so that might be part of what is causing hesitation.