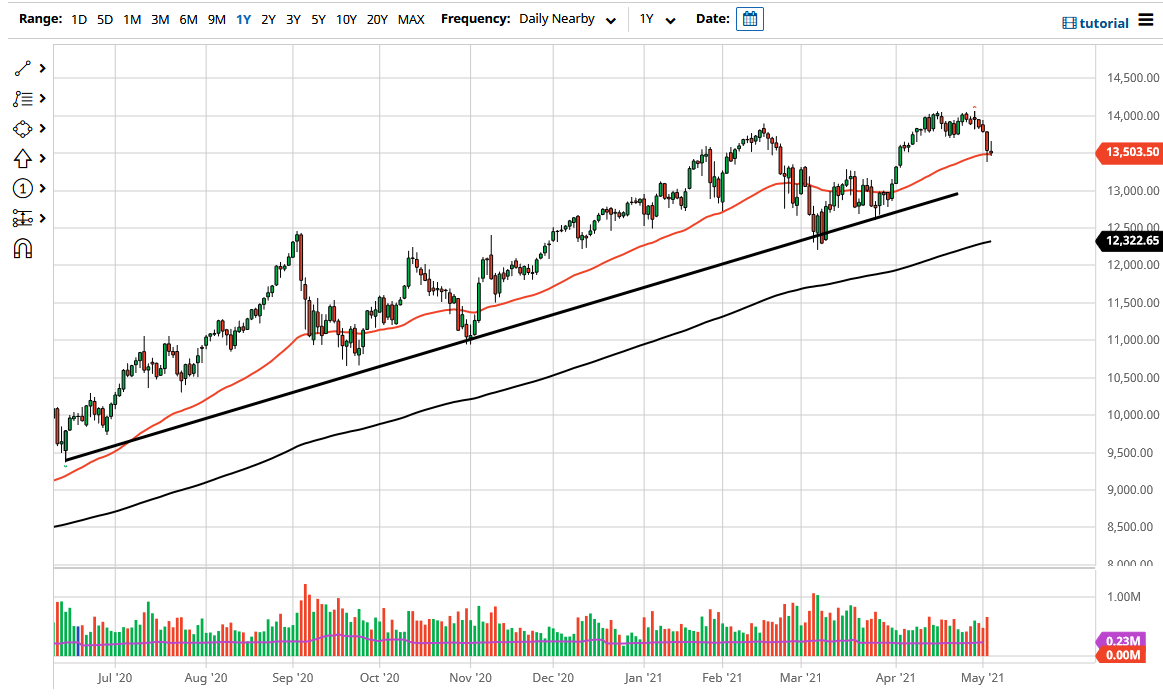

The NASDAQ 100 rallied a bit during the trading session on Wednesday but gave back the gains rather quickly. At this point, the market looks as if it is going to continue to struggle in general, as the candlestick for the trading session is forming an inverted hammer. That being said, I do see that the 50-day EMA is sitting right here as well, so there could be a little bit of psychological support. Nonetheless, the real structural support probably comes into play much lower.

However, if we were to break above the top of the candlestick, that would be very bullish sign, and it would almost certainly open up the possibility of a move back to the 14,000 handle above. Nonetheless, the jobs number comes out on Friday, so I think Thursday is probably going to be a bit of a quiet session, and I am not necessarily looking to put any money to work. However, if we break above the candlestick from the session on Wednesday, that would be a bullish sign that perhaps the market is trying to “front run the announcement”, as it sometimes will do.

The biggest problem with the Friday announcement is that estimates are all over the place, so it is hard to imagine a scenario where the market has a clear direction afterwards. I have heard estimates anywhere from 600,000 jobs added during the month of April to a higher reading of 2 million jobs added. In that type of variance, it is very easy to imagine this market struggling to find its overall directionality by the end of the day on Friday, so it would not surprise me at all to see us form a neutral candlestick.

Against that backdrop, it does not take a lot of imagination to think that perhaps most of the money will be sitting on the sidelines on Thursday, because at this point there is no reason to start gambling ahead of such a widely anticipated figure. If we do continue to break down, the 13,000 level also features the uptrend line that is continuing to propel the market higher, so I think that is about as low as we go unless there some type of massive shock to the system. I have no interest in selling regardless.