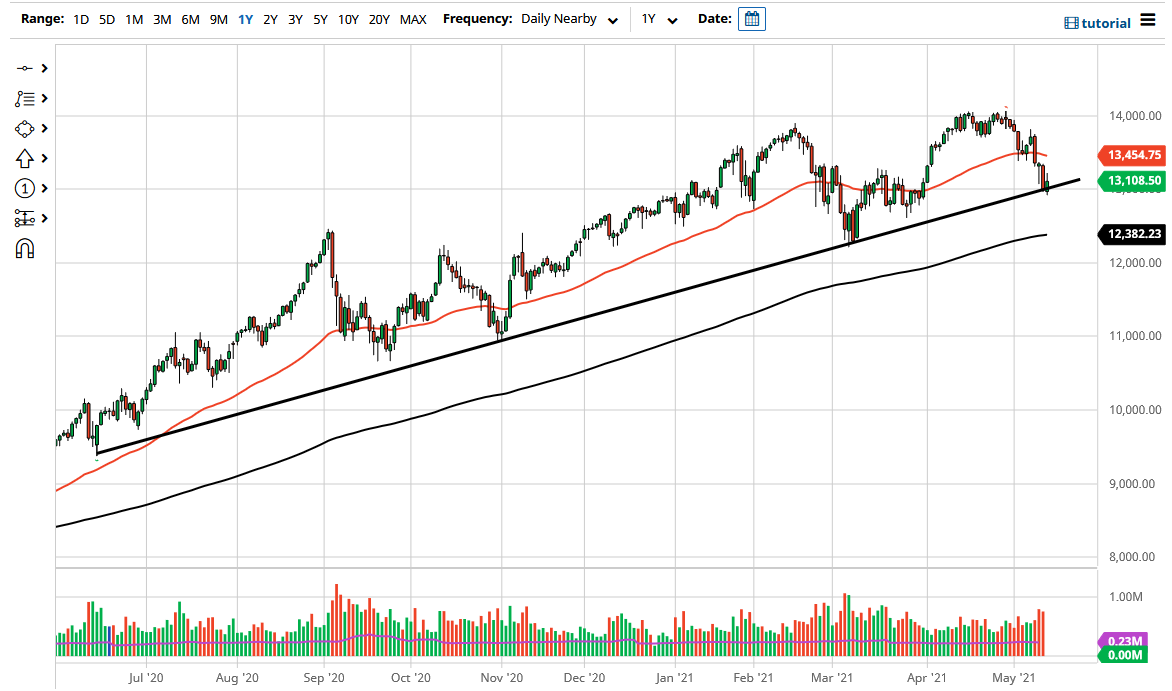

The NASDAQ 100 went back and forth during the course of the trading session on Thursday as we have tested the 13,000 level. The 13,000 level is a large, round, psychologically significant figure, and an area where we have seen buyers at previously. Furthermore, the uptrend line that I have marked on the chart has held up as well. Granted, this is not the best look as far as a candlestick is concerned, and it is worth noting that we had pulled back from the highs rather significantly. This tells me that the market is likely to continue to see a lot of volatility in trouble, so I think it will be interesting to see what happens with the next candlestick, because a break in either direction could lead to more buying or selling.

If we break above the top of the candlestick, that could send this market towards the 50 day EMA, and then eventually the 14,000 level. It is worth noting that the S&P 500 looks much better, so a lot of this could come down to the idea of rotation away from some of the bigger technology movers, and into value stocks. In other words, I think the NASDAQ 100 could have some issues ahead. This does not necessarily mean that we break down significantly, but if we do break down below the bottom of the candlestick for the session on Thursday, that probably sends the NASDAQ 100 looking towards the 200 day EMA.

If we were to break down below the 200 day EMA, then we could see a significant break and shipped lower. Nonetheless, we have still held at a crucial level, and I think it probably suggests that we will see buyers given enough time. That being said, it is very likely that we will continue to see an overall bullish attitude, just that it may be a bit hesitant to march right along with the S&P 500 and possibly even the Russell 2000. In other words, I think you probably have more momentum in those indices so the NASDAQ 100 might be better left alone in the short term. Ultimately, I would not be a seller of this market, but if we do break down significantly, I might throw a little bit of money into some put options.