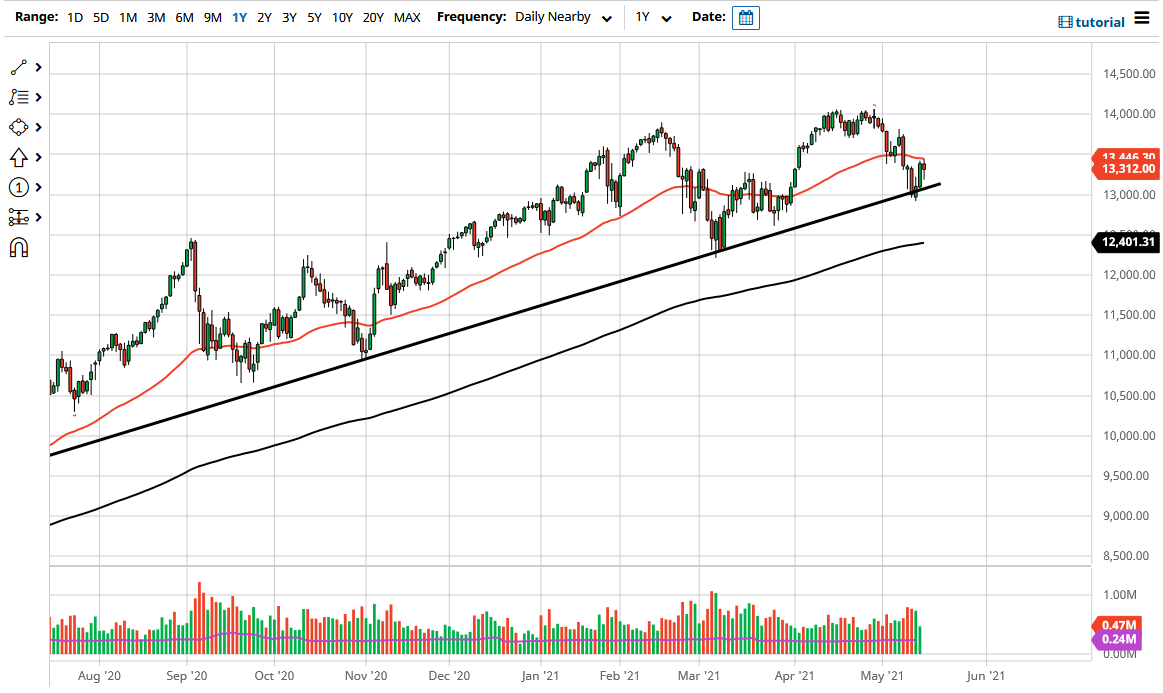

The NASDAQ 100 fell from the 50-day EMA early during the trading session on Monday but has found buyers underneath to turn things around and show signs of resiliency. The uptrend line underneath is something that we need to pay attention to, not to mention the fact that the 13,000 level is in the same area. The 13,000 level has been important more than once, and the large, round, psychological aspect of that number cannot be ignored.

That being said, it looks as if technology stocks are getting hammered a bit due to rising interest rates, which typically will work against them. You should start to look for value at that point, because typically those stocks have further to run. This works against the NASDAQ 100 Index, but we are trying to pick things up and break out to the upside. If we can clear the 13,500 level, we would not only break above a psychologically important level, but also the 50-day EMA, as well as breaking above the top of the candlestick for the Monday session, which would signify a potential continuation.

Remember, the central bank in the United States does everything it can to keep asset prices inflated, and although the talk tough occasionally, the reality is that if we see some type of major selloff, it will be short-lived, as Jerome Powell will step in and support things. Beyond that, we also have the US dollar getting hammered and that helps US stocks in general as they become cheaper for foreigners to buy. I think the fact that we recovered the way we did during the latter part of the day also suggests that we could see a bit of a move to the upside.

To the upside, I believe that the 14,000 level will continue to be a major resistance barrier, so whether or not we can break above there anytime soon might be a different question, but once we do, it opens up the possibility of a move to the 14,500 level, and then a move to the 15,000 level, which I think is the larger target over the longer term. A breakdown below the 13,000 level opens up a put-buying opportunity, but not much more than that, as the strength of the uptrend is resilient.