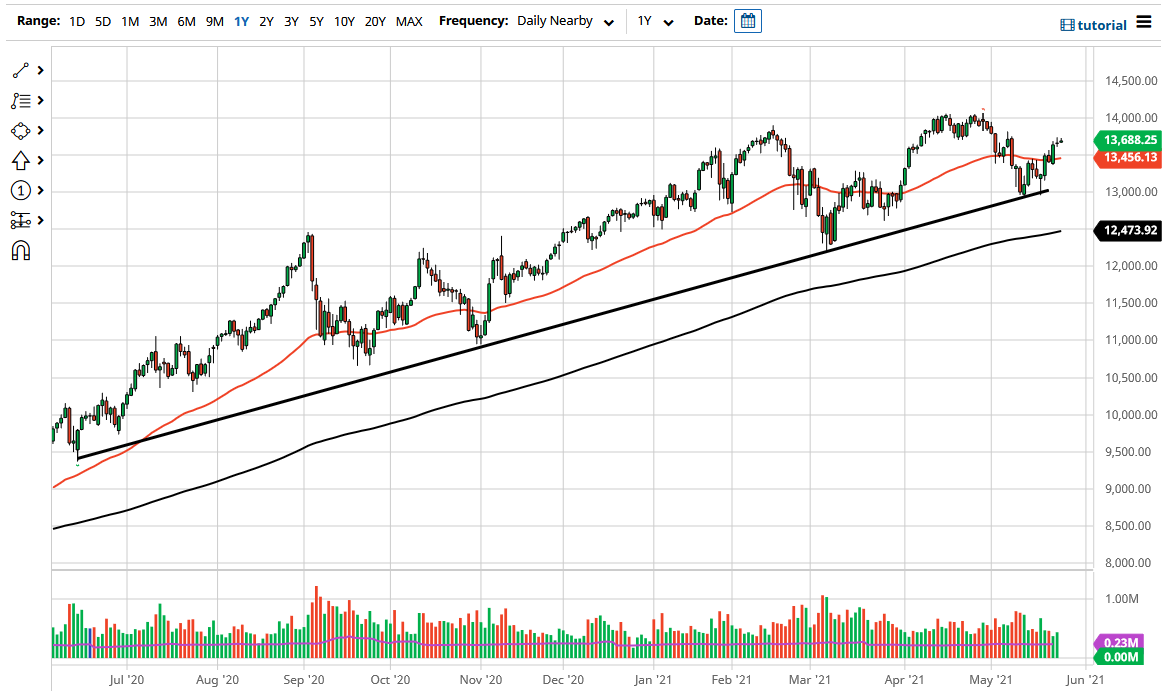

The NASDAQ 100 rallied ever so slightly during the trading session on Wednesday, as we have essentially run out of momentum. With this being the case, the market looks as if it could pull back a bit, but really at this point we are still very much in an uptrend. The 50-day EMA looks as if it is trying to turn to the upside, so that could come into play as well. Furthermore, the 50-day EMA sits just below the 13,500 level.

If we do break out to the upside, then we could go looking towards the 14,000 level, which is a large, round, psychologically significant figure, and the scene of the most recent highs. Because of this, I think that if we can break above the 14,000 level, then it is likely that the market would go higher, perhaps 14,500 and then up to the 15,000 level. The longer-term outlook for me is that we go looking towards the 15,000 handle, so I am looking at short-term pullbacks as potential buying opportunities. This is especially true as the 50-day EMA itself offers support, but so does the uptrend line that sits underneath there.

Keep in mind that the NASDAQ 100 has been bashed lately due to rotation out of growth and into value, which favors the Dow Jones Industrial Average and other indices like that. The NASDAQ 100 is moved by about seven stocks, so that is one of the biggest problems that this market struggles with. We are in an uptrend, though, so at this point I think it is only a matter of time before we take off to the upside.

If we were to break down below the uptrend line, I might be a buyer of puts, but I do not sell US indices due to the fact that central banks continue to flood the markets with liquidity, and the easiest way to deal with this market is to buy puts on the downside more than anything else. At this point, it is almost impossible to short this market, as it is so highly manipulated by the liquidity measures. This is a market that has been in an uptrend for quite some time, but obviously you will have the occasional noise.