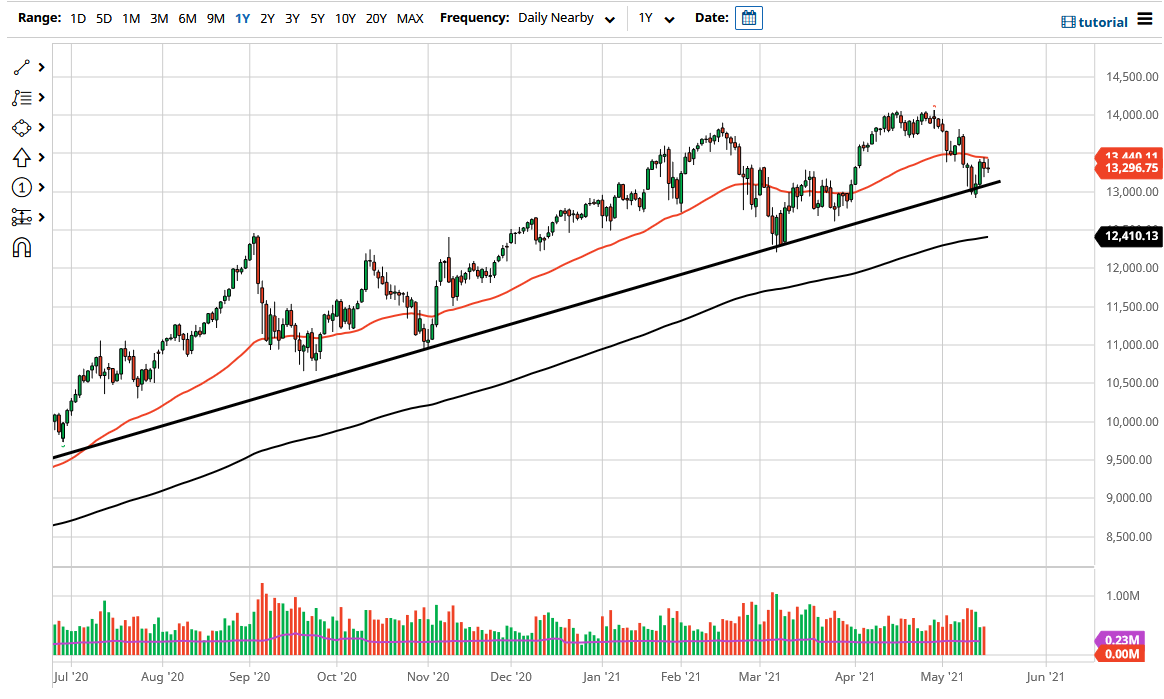

The NASDAQ 100 rallied a bit during the course of the trading session on Tuesday as we reached towards the 50-day EMA but then broke back down. Ultimately, this is a market that is still paying close attention to the 50-day EMA, so if we can break above there, then it is likely that it would turn a lot of money back into the market and go looking towards the 14,000 level. If we can break above there, then it is likely that a lot of people will try to push this above the 14,000 handle.

To the downside, we have a massive uptrend line and the 13,000 level coming into the picture as well. If we break down below the 13,000 level, then it is very likely that the NASDAQ 100 goes looking towards the 200-day EMA, and as a result I would be a buyer of puts, but not someone who would short sell this market. The Federal Reserve will continue to print dollars and we have plenty of reasons to think that will be buying assets as yields are so low, so if they do turn around, then it is likely that we see the more or less of a “buy on the dip” type of situation.

It is not until we break down below the 200-day EMA that I would remotely consider shorting, and at that point in time it would more or less be a “trapdoor opening” that could send this market much lower. I do not think that would happen very easily though, so I think it is much easier to send this market higher. The NASDAQ 100 is sensitive to risk appetite, and this will be the main driver. If we see a sudden spike in yields for the bond market, we could see money flow away from here, but given enough time I think that we will recover. If we do not, I will have my money in the S&P 500 anyway, which seems to be a little bit more insulated, not to mention the fact that the Dow Jones 30 looks even more bullish in general. While the NASDAQ 100 is a bit of a laggard, I do not necessarily think it is going to fall apart.