The NASDAQ 100 went higher during the trading session on Friday, as the jobs number came out much worse than anticipated. For those of you who still believe that the stock market has something to do with the economy, you are thinking about this the wrong way. In other words, you need to start paying attention to the one market that moves everything else: the bond market.

If bonds continue to offer less in the way of yields, people guard their wealth by purchasing growth stocks. This is where the NASDAQ 100 comes into play, as it is led by a lot of the highflyers when it comes to growth. This is exactly what we have seen during the trading session on Friday, as we have bounced from the 50-day EMA on Thursday. This is the same playbook that we have seen for quite some time, as the free money and the like out there continue to push asset prices higher.

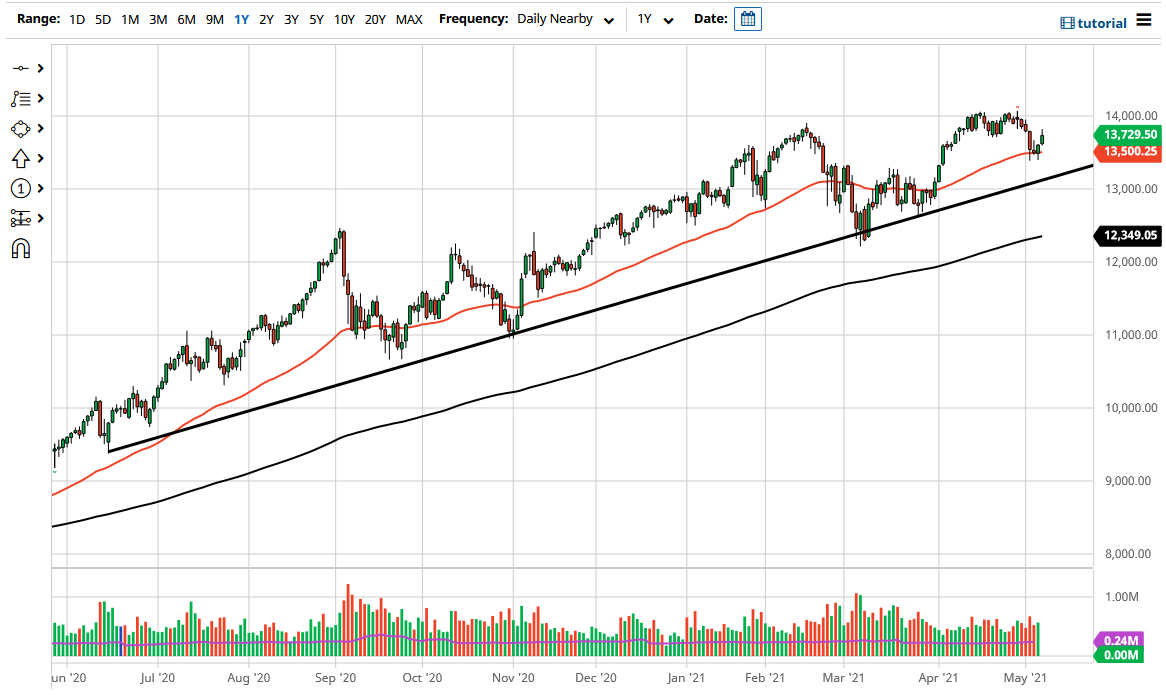

As traders continue to try to get above the inflation rate, they have to go into the stocks that grow rather quickly. Ultimately, I do think that this is a market that will go looking towards the 14,000 level above, an area that has been significant resistance. If we can break above the 14,000 level, the market is likely to go looking towards the 15,000 level. With this, I also recognize that there is a lot of support underneath, not only from the 50-day EMA but also from the uptrend line that we have on the chart as well. This is a market that will continue to see plenty of value hunters coming back into the equation when they get an opportunity.

I have no interest in trying to short this market, but I would be a buyer of puts if we break below the 13,000 level. At that point, the market is likely to go looking towards the 200-day EMA underneath. That would involve some type of significant breakdown and risk appetite, something that I do not see happening anytime soon, because the bad jobs number ensures that the Federal Reserve is very likely to remain loose with monetary policy for the foreseeable future, something that Wall Street loves.