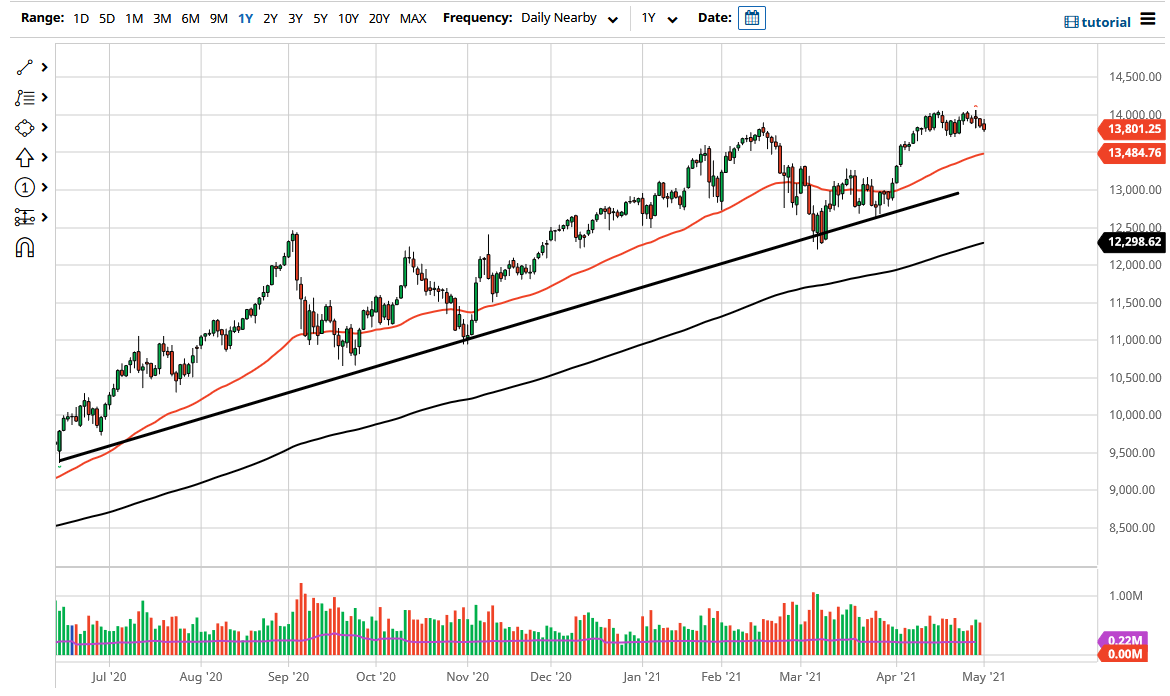

The NASDAQ 100 found the 14,000 level to be a bit too much to overcome, so it ended up pulling back to show signs of weakness. That being said, though, we are very much in an uptrend, and we are in the midst of the earnings season, so just about anything could happen as far as volatility is concerned. The market is likely to hear a lot of noise in the short term, but I do think that eventually we will try to break above the 14,000 level. If we can break above there, then we will continue the overall uptrend that we have seen previously.

I do believe that pullbacks at this point will be looked at as potential buying opportunities, as the 50-day EMA currently sits at the 13,500 level. The 13,500 level is an area where we have seen a bit of action in the past, but the 50-day EMA in and of itself is an area people will be looking at as a dynamic support level. If we break down below there, then it is likely that we will continue to see more selling pressure to go looking towards the 13,000 level.

The market will continue to be very noisy in general, but we all know that eventually the buyers come in to pick up value and the central banks around the world continue to float the risk appetite narrative. The market is likely to find any reason it can find in order to get long, because that's the behavior that we have seen for 13 years. I do not see that changing suddenly, as the market has nothing to do with the economy, and any illusion that that is the case is long gone and buried. The Federal Reserve is nowhere near tapering bond purchases, and as long as they are going to keep that point, it is only a matter of time before yields drop and the NASDAQ 100 enjoys that tailwind. If we did break down below the uptrend line, I might buy a put option, but that is about as bearish as I get. To the upside, I believe that the 14,500 level is the next target, and that the 15,000 level comes into play.